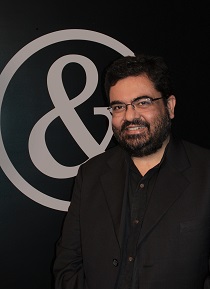

Adman Sourabh Mishra who has worked with some of India’s best known agencies like Ogilvy & Mather, Contract and Saatchi & Saatchi tells Cafemutual how he managed his money during his teenage days, his first investment and more.

What did you do with your first pay

check?

What did you do with your first pay

check?

I don't really remember - certainly paid my admission fee to the YMCA in Colaba where I stayed for six months as I trained with Contract Advertising, Mumbai.

In your teenage days, how good were you with money?

We used to be given money on a need basis. There was no set pocket money. If I needed money for something specific, I'd discuss it with my mother or father and they would then decide whether I deserved that money or not. Basic money management like transport for the week etc. was done by me. If I missed the bus, it would mean additional expense on an auto-rickshaw, which then meant using the bicycle for a couple of days... things like that.

Your first investment…

My first real investment was a few books that I always wanted and could then afford on my salary. Then a wedding ring for my wife... these were the first important investments in my life. The more conventional first investment was a life insurance policy which my office accountant asked me to buy to be able to claim some tax benefit.

One investment that you regret…

Something called a Sterling Tree Magnum certificate... driven by greed and peer pressure.

Are you a saver or spender?

A spender, if I don't watch out.

Who advises you on money? Do you take the help of a financial advisor?

Yes, I have a financial advisor who manages my investments.

Have you invested in any stocks, mutual funds or insurance? Any experience you can share with us?

I have worked with my financial advisor for about eight years now. In my experience if you don't have the time or the talent to manage your own money, you should invest in a good financial advisor. She or he understands your life goals and then works with you towards achieving them.

They also bring in a certain financial discipline, which is critical to good money management. And we do our periodic reviews to see where we are on our investments. My financial investor's incentive on stock investment is based on the performance of the portfolio, which keeps him actively involved with managing the investment. On the mutual fund part, it is the commission that he gets from the fund house.

The only other financial decision I've taken on my own is to opt for voluntary provident fund (VPF) deduction every month. This is PF deducted over and above the statutory requirement and is like forced additional saving with a good, tax-friendly rate of interest.

It is said that creative people are not good at managing money. Your comments…

On an average, I have seen that more creative people are likely to find the day to day discipline of managing money an uninteresting chore which they would be happy to let someone else take care of on their behalf.

What would be your advice on money management to youngsters who have just started earning?

Start a systematic investment plan of some sort from your first salary. And stick to that discipline. I wish I had.

If not an adman, you would have been…

Probably in the food business.