The ratio of financial assets to physical assets in total wealth (55:45) is expected to remain the same, shows a Karvy report.

Wealth held by individuals in India is expected to double to Rs. 411 lakh crore in five years from the current Rs 201 lakh crore, shows a Karvy Wealth report.

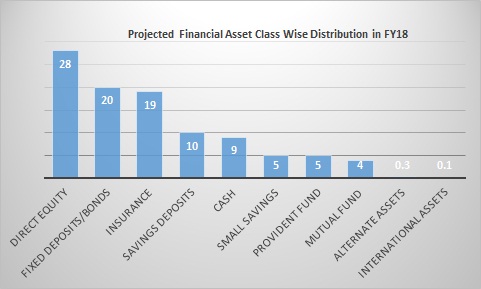

Individual wealth in financial assets is expected to grow from the current Rs. 109.86 lakh crore to Rs. 228.36 lakh crore by FY18. However, the report says that Indians affinity towards physical assets will continue to remain same. Investments in physical assets which is Rs. 92 lakh currently is expected to increase to Rs 183 lakh crore by FY18.

Global individual wealth

Global individual wealth is expected to grow at CAGR of 4.8% over the next five years to reach US$171.2 trillion by the end of 2017. Overall, the Asia-Pacific region (excluding Japan) will account for the bulk of the increase in global wealth through 2017. (BCG Global Wealth Report 2013)

The global population and investible wealth of HNIs both increased substantially to reach record levels in 2012. The population of HNIs grew by 9.2% worldwide, increasing by one million individuals to reach 12.0 million. Global HNI wealth, increased by 10.0% to reach US$46.2 trillion above the pre-crisis level of US$40.7 trillion in 2007 and the previous high of US $42.7 trillion in 2010. (BCG Global Wealth Report 2013)

Key trends

- The Wealth held in real estate (excluding primary residence of the individual) is expected to double in the next three years.

- In the coming years with improvement in the economy and the percentage of households owning primary homes set to increase to greater than 90%, the fresh inflow into physical assets will increase at a decreasing rate.

- With expected upturn in the economy there will be a gradual shift of more financial savings being invested in equities.

- Even with a higher minimum investment size, alternative investments such as high yield debt, private equity, real estate funds and hedge funds will remain popular among the HNIs.

- With the expansion of workforce and pension benefits being limited for the newer generation from employers/government, retirement/pension funds are expected to grow at a rapid pace in the next decade.

Composition of individual wealth in alternative assets

|

Asset Class |

Amount (Rs. cr) |

|

Structured products |

12,150 |

|

Gold ETFs |

5,289 |

|

Private equity funds |

4,117 |

|

Real estate NCDs |

4,000 |

|

Real estate funds |

3,406 |

|

Art funds |

1,087 |

|

Film funds |

904 |

|

Hedge funds |

600 |

|

Total alternative investments |

31,553 |

Source: Karvy Wealth Report