Out of the Rs. 2.36 lakh crore equity assets managed by top ten fund houses, 10 percent or Rs. 23,218 crore is invested in direct plans.

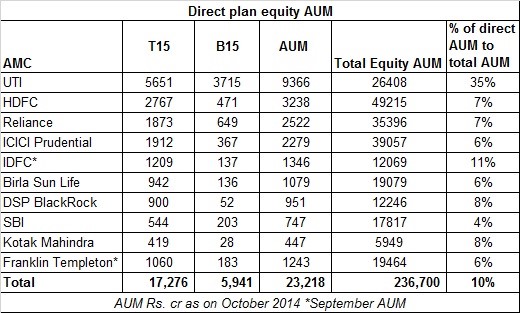

An analysis of the direct plan AUM of equity funds of the top ten fund houses shows that investors have poured in Rs. 23,218 crore through the direct channel. Out of the Rs. 2.36 lakh crore equity assets managed by top ten fund houses as on October 2014, 10% or Rs. 23,218 crore is invested in direct plans.

Among the top ten players, UTI had the highest proportion of investors investing through direct plans in its equity schemes. Out of Rs. 26,407 crore equity assets managed by the fund house as on October 2014, Rs. 9,366 crore or 35% came through the direct channel.

Apart from investors, its sponsors have also invested in direct plans - Rs. 180 crore in direct plans of equity funds with Rs. 115 crore being invested in UTI-Leadership Equity Fund.

After UTI, HDFC had the highest proportion of

equity assets in direct plans. Of the Rs. 49,215 crore equity AUM, 7% or Rs. 3,238 came through direct

plans.

An analysis of geographical concentration of assets shows that a

large part of direct plan AUM in equity funds came through the top 15 cities.

Out of the Rs. 23,218 crore invested in direct

plans of equity funds, 74% came from top 15 cities while the remaining Rs. 5941

crore came from beyond the top 15 cities. This shows that direct plans are not

that popular is smaller towns yet.

Direct plans were introduced in January 2013.

Majority of equity fund investors are retail. AMFI data shows that out of the Rs. 2.96 lakh crore equity AUM as on September 2014, retail investors share stood at Rs. 2.90 lakh crore.

Fund officials say that only savvy investors like HNIs and corporates are investing money in direct plans of equity funds. On an average, direct plans of equity funds charge one percent less than regular plans.

Balanced schemes, ETFs and fund of funds were excluded from

this study.