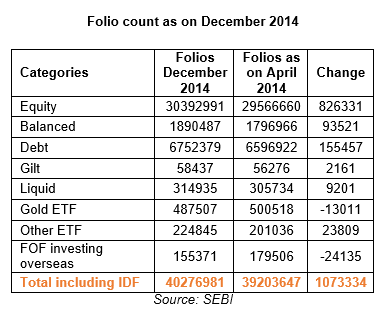

Equity folios have risen by 8.26 lakh during the same period, shows the latest SEBI data.

Investors are rushing to equity funds even as the markets reach new highs.

This was evident from the addition of 8.26 lakh in equity folio count in April-December 2014 as per SEBI data. Investors poured in Rs. 50,385 crore in equity funds from April till December 2014.

Reflecting the positive sentiment among investors, the industry has added over 3.68 lakh folios in equity funds in December itself.

The total AAUM of equity mutual funds (including ELSS) has reached an all-time high at Rs.3.20 lakh crore in December. Thanks to mark to market gains and inflows, the equity AUM went up by 67% or from Rs.1.92 lakh crore to Rs. 3.20 lakh crore in the same period.

Advisors say that retail investors have flocked to equity funds due to the optimism surrounding the market and the stellar returns delivered by equity funds. Value Research data shows that mid and small cap funds have delivered an absolute return of 74% in the calendar year 2014. The S&P BSE Sensex went up by a whopping 5053 points or 23% in April-December 2014. Sensex crossed 28,000 mark in this period while CNX Nifty too touched an all-time high of 8500 points.

However, ELSS saw depletion of more than 1.5 lakh folios during the same period. Advisors say that investors tend to redeem their investments as soon as the three year lock in period gets over causing depletion in ELSS folios.

Barring gold ETF and fund of funds investing overseas, all other categories saw an addition in folios in April-December 2014. The industry added close to 1.55 lakh folios in debt funds and 2161 folios in gilt funds in April-December 2014.Meanwhile, ETFs which track the equity indices added close to 24000 folios in the same period.

All in all, the industry added over 10 lakh folios between April-December 2014 due to rise in equity, debt and balanced fund folios. The total folio count across all categories increased to 4.02 crore in December from 3.92 crore in April.