Since December 2014, 16 offer documents of equity schemes are waiting SEBI nod.

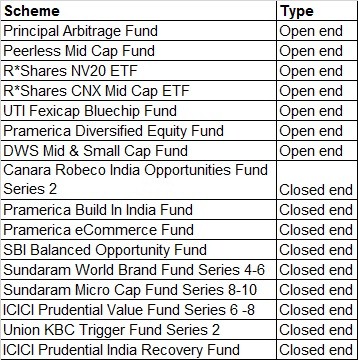

Fund houses are rushing to file offer documents with SEBI to cash in on the optimism surrounding the market. In the last two months, fund houses have filed offer documents to launch 22 new equity schemes with SEBI. They include a mix of open end, closed end and exchange traded funds.

While some fund houses are planning to come up with the next series of their existing closed end schemes, others are completing their product bouquet, hoping to get their share of investor’s wallet. Sundaram has filed offer documents for the next series of its World Brand Fund and Micro Cap Fund while ICICI Prudential is planning to bring two more series of its Value Fund. The fund house is planning to launch another closed end fund called ICICI Prudential India Recovery Fund. Union KBC is planning to come up with the second series of its Trigger Fund.

Buoyed by the decent response to closed end funds launched by their larger peers, emerging AMCs are also jumping the closed end bandwagon. After Canara Robeco and DWS, Pramerica has filed offer documents with SEBI to launch two closed end funds - Pramerica Build In India Fund and Pramerica eCommerce Fund.

Offer documents filed with SEBI during since December

Since April 2013, when IDFC started the trend of closed end fund with the launch with its Equity Opportunities Fund, the BSE Sensex has rallied 45%. Distributors say that with the reforms unveiled by the government and expected recovery in economy, the market is expected to reach new highs and which is why fund houses are coming up with new funds. “It is herd behavior. Investors want to enter markets during a Bull Run. It is easier to sell when markets are up which is why AMCs are coming up with new funds. Distributors put more efforts in selling new funds than existing funds, especially if the theme is unique and the incentives are good,” said a Mumbai based distributor who manages assets under advisory of nearly Rs. 400 crore.

More

than the new fund offers, it is the existing schemes with track record which

are attracting more inflows. SEBI data shows that net inflows in open end

equity funds stood at Rs. 46,904 crore while closed end equity funds saw

inflows of Rs. 9,803 crore during April-January 2015. “We always recommend

investors to go for existing funds which have a good track record as we don’t

want investors to compromise on liquidity,” said Nikhil Kothari of Etica Wealth Management.