The total number of retail equity folios went up from 2.86 crore in March 2014 to 3.08 crore in March 2015.

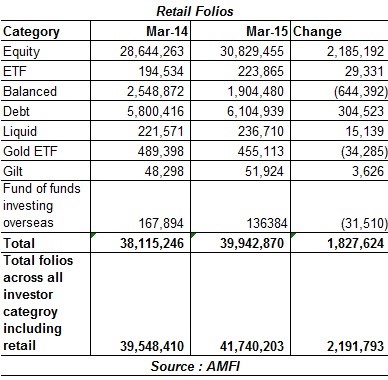

Retail investors are taking a shine to equity funds. The latest AMFI data shows that equity funds added 21.85 lakh retail folios last fiscal. The total number of retail equity folios went up from 2.86 crore in March 2014 to 3.08 crore in March 2015. The total folios (across all investor category including retail) equity funds went up by 25 lakh last fiscal.

Industry officials attribute the rise in retail folios to a slew of new fund offers and new SIP registrations in existing funds. The BSE Sensex gained 25% last fiscal which helped equity funds attract net inflows of Rs. 71,029 crore.

Fund of funds

This category is continuously losing folios. FOFs investing overseas lost 31,510 folio last fiscal while the assets under management fell by Rs. 784 crore from Rs. 3,192 crore to Rs. 2,408 crore. Funds investing in China and US have been the top performers. Value Research data shows that funds like Mirae Asset China Advantage Fund, MOSL NASDAQ 100 ETF, JP Morgan JF Greater China Equity were among the top performers with absolute returns of 32%, 31% and 30% over a one year period. Funds having exposure to Brazil, gold, mining, commodities were the worst hit.

Balanced

While the total assets under management in this category grew by Rs. 9,575 crore, balanced funds saw a depletion of 6.22 lakh folios. Balanced funds have delivered 39% (category average) absolute returns over a one year period.

Debt

Retail folios in debt funds went up by 3.04 lakh last year from 58 lakh in March 2014 to 61 lakh in March 2015. The total AUM in the category jumped by Rs. 55,977 crore from Rs. 4.60 lakh crore in March 2014 to Rs. 5.16 lakh crore in March 2015. Retail assets in debt funds increased by Rs. 6,847 crore last year.

Liquid

Retail

folios in liquid funds increased marginally by 15,139 while the AUM increased

by Rs. 365 crore. The total AUM in the category went up by Rs. 29,282 crore

from 1.33 lakh crore in March 2014 to Rs. 1.62 lakh crore.

All in all, the industry added 21.91 lakh folios, largely due to addition of folios in equity funds. The total number of folios in the industry went up from 3.95 crore in March 2014 to 4.17 crore in March 2015.