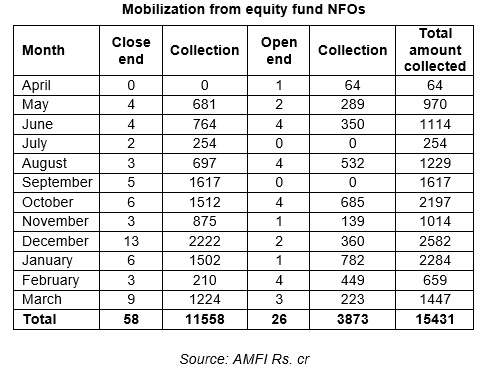

The mutual fund industry has mobilized Rs.15,400 crore from 84 equity fund NFOs in FY 2014-15, shows an analysis of NFO data compiled from AMFI website.

Of this, a major chunk of money has come in close end equity funds. Around 58 close end equity funds collected close to Rs.11,500 crore last year. Most of the closed end funds are focused on investing in mid and small cap stocks. The trend of close end funds started last year with IDFC’s Equity Opportunities Fund. Reliance Capital Builder Series B was the highest grosser in the close ended equity fund category which collected over Rs. 1,000 crore.

Meanwhile, 26 open ended equity NFOs collected Rs.3,873 crore last fiscal. Birla Sun Life Manufacturing Equity Fund mopped up the highest (Rs.782 crore) in the open end category. However, majority of open end equity NFOs got average response due to the absence of any differentiating factor.

Overall, the industry has attracted inflows of over Rs.71,000 crore in equity funds in FY 2014-15. The total AAUM of equity mutual funds (including ELSS) has reached an all-time high at Rs.3.45 lakh crore as on March 2015 due to mark to market gains, inflows in existing schemes and NFOs. Also, SEBI data shows that the industry has added over 30 lakh equity folios last fiscal.