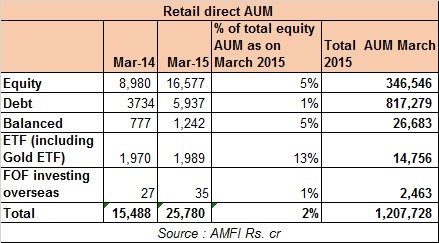

Retail direct plan equity base grew by 85% from Rs. 8,980 crore in March 2014 to Rs. 16,577 crore as on March 2015.

An analysis of direct plan AUM shows that retail investment in direct plans has gone up by 66% from Rs. 15,488 crore in March 2014 to Rs. 25,780 crore in March 2015.

The highest increase in retail AUM of direct plans was seen in equity category. Retail direct plan equity AUM grew by 85% from Rs. 8,980 crore in March 2014 to Rs. 16,577 crore in March 2015.

Fund officials attribute this partly to mark to market gains. The BSE Sensex has gained 25% last year and the overall equity asset base has also risen by 88% from Rs. 1.84 lakh crore in March 2014 to Rs. 3.46 lakh crore in March 2015. The industry has received Rs. 71,029 crore net inflows in equity funds last year.

“The direct AUM has increased due to mark to market gains and fresh inflows in equity funds,” said D P Singh, Executive Director & Chief Marketing Officer (Domestic Business), SBI Mutual Fund.

Of Rs. 16,577 crore direct retail equity AUM, retail investors from B15 cities had invested Rs. 5,935 crore in equity funds. This shows that the popularity of direct plans is increasing even in B15 cities.

AMFI data shows that retail investors have invested Rs. 16,577 crore in direct plans of equity funds as on March 2015, which is 5% of the total Rs. 3.45 lakh crore total equity asset base of the industry. If we include HNI, corporate, FII and banks, the direct plan AUM in equity funds goes up to Rs. 37,136 crore, which is 11% of the total Rs. 3.46 lakh total equity AUM as on March 2015.

The retail direct AUM increased across all categories like balanced funds, ETFs, fund of funds and debt funds last year.

Of the Rs. 12 lakh crore asset base of the industry, retail investors held 2% or Rs. 25,780 crore in direct plans.

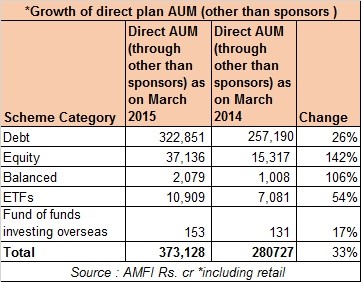

Overall, direct plan AUM (excluding sponsor contribution) grew by 33% from Rs. 2.80 lakh crore in March 2014 to Rs. 3.73 lakh crore in March 2015. Direct plans now constitute 31% of the total Rs. 12 lakh crore AUM of the industry. (See table below)

B15 & T15

Majority of inflows in direct plans came from the top 15 cities. Of the Rs. 3.73 lakh crore direct AUM as on March 2015, 88% or Rs. 3.31 lakh crore was sourced from T15 cities while the rest came from B15 cities.

However, the contribution from B15 cities in direct plans is increasing. AMFI data shows that B15 direct AUM went up from Rs. 30,163 crore in March 2014 to Rs. 41,252 crore in March 2015. Of Rs. 41,252 crore 77% or Rs. 31,985 came in direct plans of debt funds. Experts say that the rise in direct plan AUM in B15 cities was due to increasing awareness in B15 cities about mutual funds and particularly about direct plans.

Sponsors contribution in direct plans was excluded from this study.