Insurance forms the third-largest asset class with a 14.08% share in total individual financial assets after direct equity and FD, said India Wealth Report 2019 by Karvy Private Wealth.

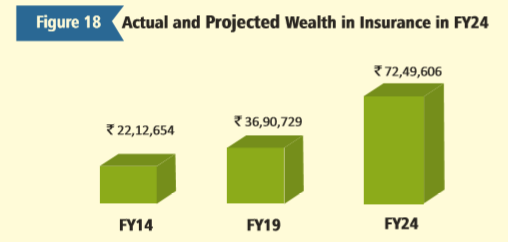

Individual wealth in insurance may grow at a CAGR of 14.46% in the next five years from Rs.36.9 trillion in FY19 to Rs.72.4 trillion in FY24, the report predicted.

The report says that there is still a huge market for advisors and agents to explore in the insurance sector. In a nation of 1.3 billion people, it is quite surprising that our insurance coverage is as low as 20%, the report said. Adding to it, the majority of Indians are not adequately insured. This means more than 80 % of Indians are yet to buy sufficient life insurance cover under any life insurance scheme.

Going ahead, multiple growth drivers will be:

- Increased awareness about the importance of buying an adequate insurance cover, with efforts by life insurance companies for educating Indians across the length & breadth of India

- Increased availability & ease of purchase with the use of technology for online purchase, including from mobile applications on smartphones.

- Regulatory changes and continuation of income tax benefits

- Changes in demographic factors such as growing underinsured younger population with need of child plans & older population with need of retirement plans