The Indian insurance industry did not face much discomfort in covid-hit 2020. Total insurance premium went up 0.1% in India compared to 0.04% growth worldwide, shows latest IRDAI data.

Citing a report by Swiss Re, the insurance regulator said that India ranks eleventh in the global insurance business, with a share of 1.72% in 2020. The share went up marginally in 2020 from 1.69% in 2019.

In life insurance, India maintained its tenth rank in 2020 with 2.9% share. In non-life insurance, India jumped one spot to the 14th rank.

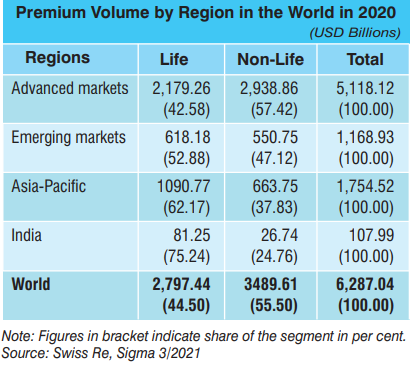

Life insurance business still dominates the Indian insurance space. It has a share of 75.24% in India as against 44.5% globally, according to the IRDAI report. Of the total $107.99 billion (Rs. 8.05 lakh crore) premium collected in 2020, $81.25 billion (Rs. 6.06 lakh crore) went into life insurance.

Credit: IRDAI Annual Report 2020-2021

Penetration goes up marginally

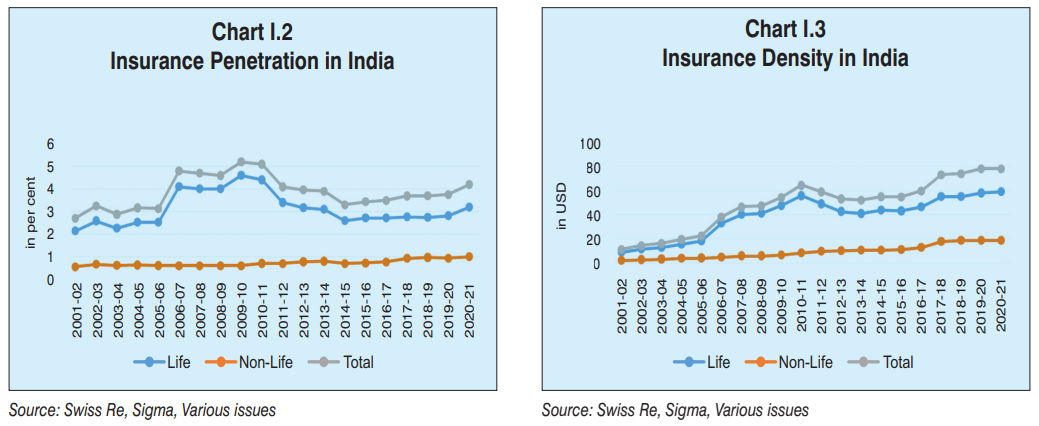

Insurance penetration went up in FY 2020-2021 to 4.2% from 3.76% in FY 2019-2020.

Insurance penetration is measured as percentage of premium to GDP.

"While the penetration of life insurance sector has gone up from 2.15 per cent in 2001-02 to 3.20 per cent in 2020-21, non-life insurance penetration has gone up from 0.56 per cent to 1.00 per cent during the same period," the report said.

Density remains constant

Insurance density, which is calculated as the ratio of premium to population, remained unchanged at $78 in FY 2020-2021. Life insurance density is $59 and non-life insurance density is $19.

"As per Swiss Re Sigma report, globally insurance penetration and density were 3.30 per cent and USD 360 respectively for the life segment and 4.10 per cent and USD 449 respectively for the non-life segment in 2020," the report said.

Change in insurance penetration and density over the years:

Credit: IRDAI Annual Report 2020-2021