Listen to this article

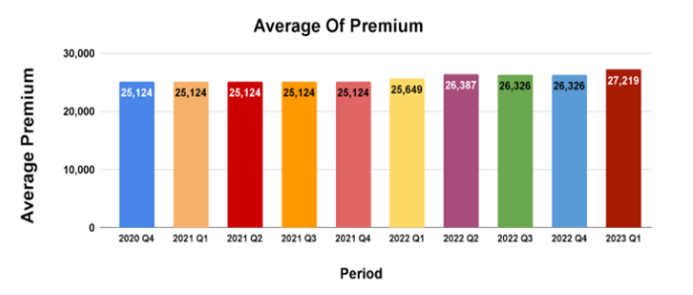

The average premium prices for health insurance marginally increased by 3.4% from Rs. 26,326 to Rs. 27,219 in the last three months, as per a study by PolicyX.Com, an online insurance distributor. On annual basis, the rise is 6.1% or Rs. 1,570.

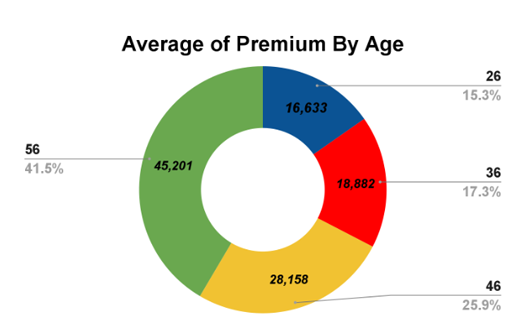

The report also highlights the key factors that determine the premium amount - age, number of members, and sum insured.

Age

The average premium prices understandably kept rising as the age increased.

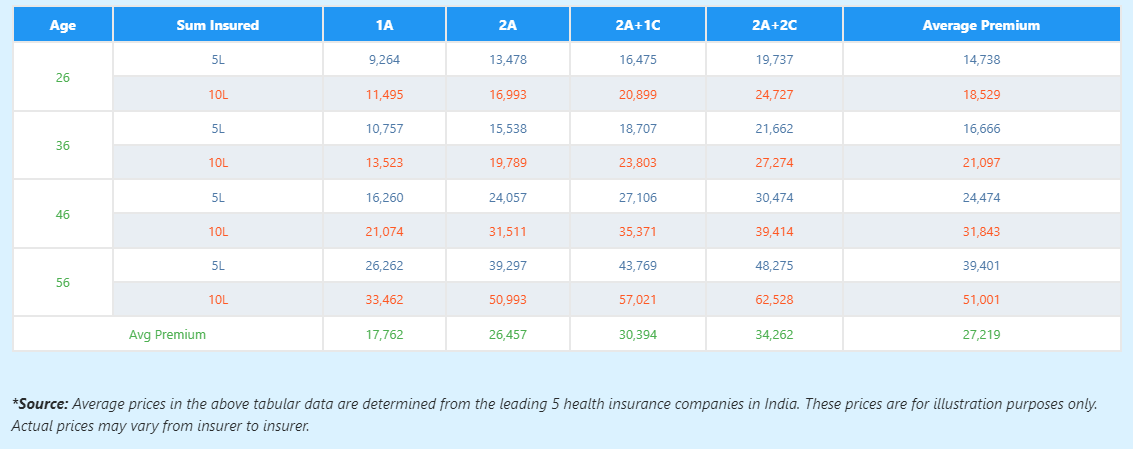

Number of members

Family floater plans are generally less expensive than individual policies, says the report. Further, the report states there is an average increase of premium of 44.5% on adding 1 more adult of the same age as against 20.4% on adding a child to the policy.

Sum insured

The report illustrates that premium does not rise proportionately with rise in sum insured. For example, the premium of Rs. 9,264 for an average age of 26 for a sum insured of Rs. 5 lakh increases to Rs. 11,495 for a Rs. 10 lakh cover. While the sum insured increases by 100%, the premium rises by only 24.1%.

Additionally, the report compiles the average health insurance premium of top 5 health insurers across categories.

Methodology

PolicyX.Com has based its findings on the average premium prices of 5 health insurance companies, namely Star Health and Allied Insurance, ICICI Lombard General Insurance, Bajaj Allianz General Insurance, HDFC ERGO General Insurance and Care Health Insurance.

And, the prices represent the annual premium prices for each sample client pertaining to age, coverage type and sum insured during April -June 2023. However, the insurer’s individual rate may vary depending on various factors.