The non-life insurance industry has been steadily improving the quality of services they provide to customers. So it seems from the healthy grievances redressal statistics.

The general insurance industry resolved 98.5% of complaints in FY 2015-16 as against 96.5% in the preceding fiscal, shows IRDAI’s annual report. Over 60,000 complaints were resolved last fiscal. The number of outstanding complaints stood at 971 in FY 2015-16.

“The private general insurance companies resolved 99% of the grievances while the PSU non-life insurers resolved 97.12% of the complaints handled by them,” says the IRDAI annual report.

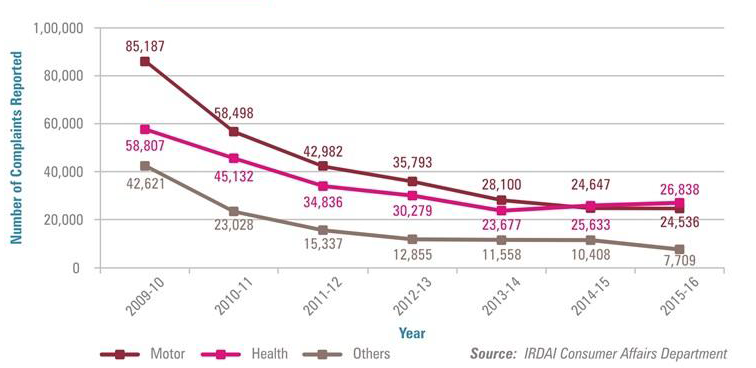

Further, a constant decrease in the number of complaints was observed as well. There has been a reduction of over 1600 complaints in the FY 2015-16.

Claims and policy related grievances continued to remain high. However, there was a small reduction in complaints related to insurance premium.

The classwise details of complaints reported reveals a consistent declining trend in complaints relating to all classes of business. Apart from health insruance, the other segments such as motor insurance saw a decrease in the number of complaints reported.

Interestingly, IRDAI annual report stated that six non-life insurers - L & T General, Magma HDI General, Max Bhupa Health, Raheja General, Shriram General and Universal Sompo had declared that they had no pending complaints for FY 2015-16.