A Campden Family Office and Edelweiss Private Wealth Management report titled ‘A Roadmap for the Indian Family Office’ shows that Indian family office clients have the highest exposure to fixed income securities globally.

Equities, private equity funds and real estate followed fixed income, finds the report.

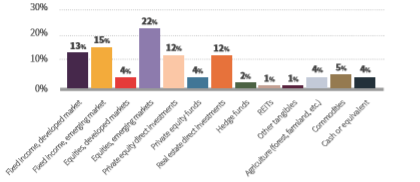

A closer look at asset allocation of wealthy Indians found that they have 28% exposure to fixed income securities across the world. While their exposure to equities accounted for 26%, 16% of their wealth was invested in private equity funds. Real estate and properties were 12% of their total wealth.

Around 2% of respondents said they invested in hedge funds, 4% in agriculture, 5% in commodities, 1% in REIT and the remaining 4% in cash or equivalents.

The report further said that most HNIs in India would increase their exposure in equities over the next one year; among key reasons given for this were rebalancing the portfolio and willingness to take more risks for high rewards. The report said, “The most common response was to maintain the same level of investment suggesting that for many a balanced investment strategy will endure.”

One of the HNI respondents who is also runs a family office set up said, “Equities get you the highest returns. Currently, India has got a booming economy, a lot of businesses are doing well, so we want to participate through buying their equity. We will do this by liquidating some of the real estate assets and diverting it towards equity holdings.”

According to the survey, India remained the focus for family office clients as 99% of respondents said they invested in India. On global exposure, 14% of wealth Indians also invested in North America, 11% in Europe, 10% in Asia-Pacific, 7% in the Middle East and 5% in Africa.

The report said that HNIs of older generation preferred a conservative approach while the younger generation favoured a more aggressive growth-oriented model.

Here is the asset allocations of super rich Indians