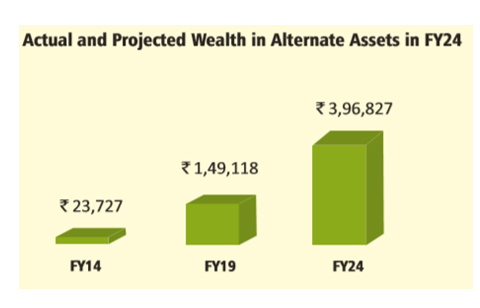

‘India Wealth Report 2019’ from Karvy Wealth estimates that AUM of AIF industry will grow by 166% in the next five years i.e. from Rs.1.49 lakh crore in FY 19 to Rs.3.96 lakh crore FY 24.

The report attributes this growth to rising popularity of AIFs among HNIs. In fact, most HNIs have increased their investments in the last one year by investing more in sophisticated asset classes like venture capital, private equity, structured products and high yield debt.

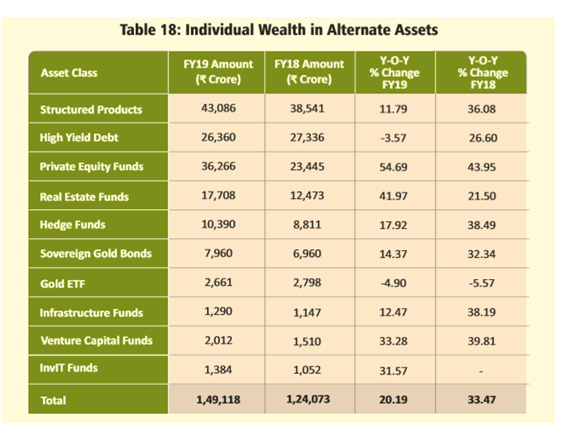

The study shows that investment towards private equity funds was higher than any other alternative asset class. PE funds saw over 54% year-on-year rise in FY19 to Rs.36,266 crores. “Private equity funds saw substantial growth over the past 3 years. This is a preferred investment class globally and some family offices have started making direct private equity investments or co-investments along with the funds,” said the report.

Another alternative fund to gain HNIs attention was real estate funds as it grew nearly 42% in FY19 to Rs.17,708 crores. However, the report said that of late these funds have been affected by the overall slowdown in real estate.

Further, it showed that investments in high yield debt fell over 3% in FY19 compared to a 26% rise in FY18 due to the risk of default on debt products. This decline in investment growth was due to the liquidity crisis in the latter half of FY19.

Gold ETF was another asset class that saw a decline in annual growth as it fell nearly 5% to Rs.2,661 crores. Meanwhile, InvIT funds witnessed a healthy 31.57% of growth during the period.

The report mentioned that globally, there has been a rapid increase in alternative investments, especially within the family offices, endowments, pension funds, and institutional treasuries.

This trend is gradually catching up in India as well where we have seen a steady shift towards alternative investments over the last decade.

Overall, the report forecasts individual wealth in alternative investments to grow at a CAGR of 21.62% for the next 5 years. “Today the rich in India have displayed a liking for alternative assets that satisfy their relatively higher risk appetite and also challenge their intellect. Alternative investments are not for masses or retail investors as these are a high ticket and mostly high-risk products,” said the report.