Listen to this article

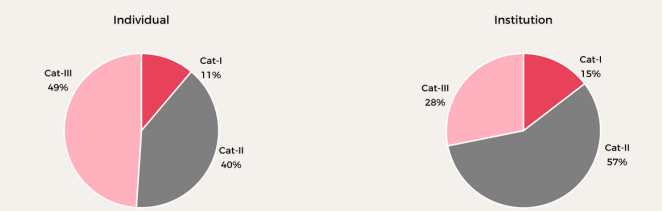

A study conducted by CAMS and Equalifi shows that close to 44% to the total AIF AUM has come from individual investors including NRIs.

While individual investors account for 38% of the total AIF AUM, NRIs contribute 6% to the total asset base of AIFs.

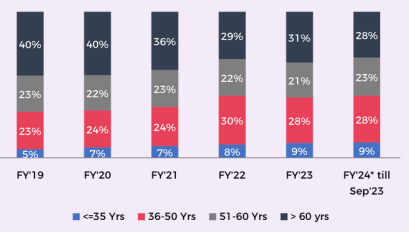

In terms of age wise distribution, majority of AIF investors are 50 plus. The data reveals that these investors account for 51% of the individual AIF AUM. However, their overall contribution declined substantially in five years.

This due to increased participation from individuals in the age group of less than 50 years. Their contribution has increased from 28% in FY 19 to 37% in FY 2023.

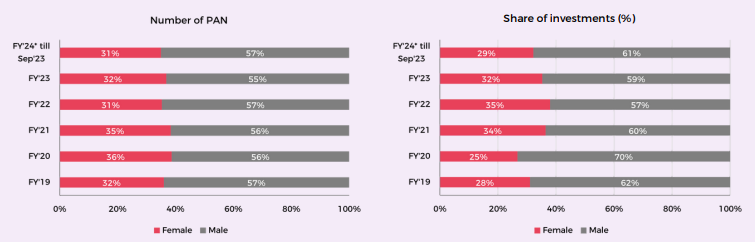

Further, in terms of gender demographics, the report shows an increased participation of women investors. It says, “Women investors making up over a third of the investor base is a great sign of their confidence to choose alternatives led wealth creation, narrowing the gender divide in the traditionally male dominated investment space.”

Their contribution to the overall individual AIF AUM of women increased to 32% from 28% in five years.

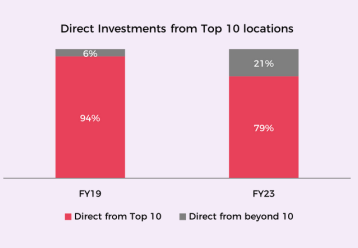

In terms of geographical demography, the report shows an increase in AIF investments in smaller towns and cities from 6% in FY19 to 21% in FY23. It says, “Over 72 cities and towns have investments in excess of Rs.50 crore each, while 50 cities and towns have brought in over Rs.100 crore each, pointing to growing opportunities beyond top tier cities.”

These investors put majority of their money in Cat III AIFs. Almost 50% of induvial AIF assets were invested in long only funds and long and short funds.