A basic tenet of investing is buying low and selling high. Another basic tenet of investing is investing systematically through a disciplined and long term approach to create wealth. However, both the tenets are often ignored because fear and greed are stronger than long-term investing discipline.

A basic tenet of investing is buying low and selling high. Another basic tenet of investing is investing systematically through a disciplined and long term approach to create wealth. However, both the tenets are often ignored because fear and greed are stronger than long-term investing discipline.

What is even sadder is that the public normally buys at highs and sells at lows, which grossly undermines returns and investors ends up losing money and not being happy with the investment decision or the financial planner.

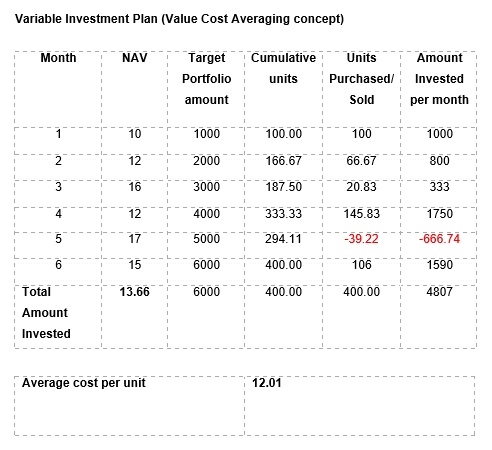

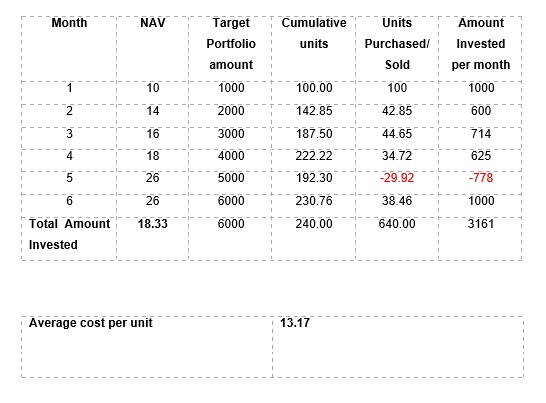

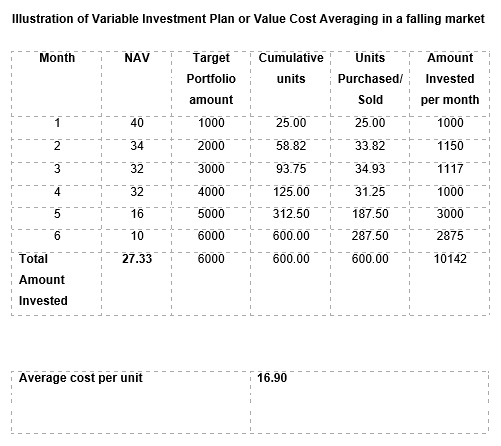

alue Cost Averaging (VCA), is an investment technique similar to systematic investing (SIP), where investments are made systematically over a period of time, but the quantum of investment in VCA changes depending on market fluctuation.

This ensures your portfolio value rises by a specified amount at every installment period, regardless of market conditions. Sounds interesting..? Read on.

VCA enables financial planners reach the desired goal amount in a more predictable manner.

VCA fixes a target amount each month, and ensures this target amount is maintained every month, irrespective of the market price. Therefore, the investor buys or sells, only those units that are required to maintain the predestined portfolio worth at each revaluation point, which is typically every month.

Therefore, the simple principle is, in falling markets, one buys more units and in rising markets, one buys fewer units or one may even be required to sell some units to maintain the target portfolio amount.

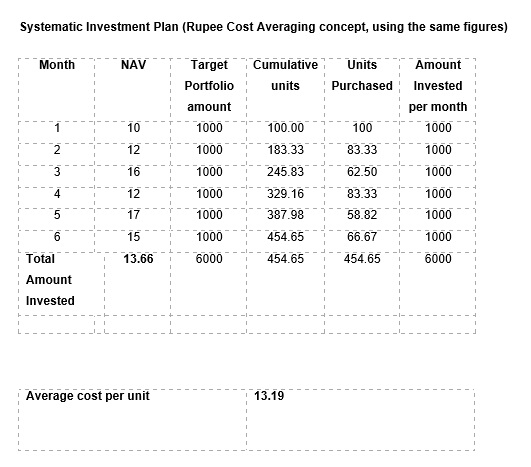

In Systematic Investment Plan (SIP), a fixed amount is invested every month, irrespective of the predetermined portfolio value where the fixed amount buys a number of units based on the prevailing NAV. Underlying this approach is Rupee Cost Averaging where more units are purchased when price is low and vice versa.

Therefore, the distinctive feature of VCA over SIP is as a rule, VCA may also result in selling some units, to maintain the desired portfolio target, which SIP does not do.

An illustration is provided below on the workings of VCA and SIP

Illustration of Variable Investment Plan or Value Cost Averaging in a rising market

Therefore, Value Cost Averaging helps in achieving:

- Lower average cost per unit when compared to SIP.

- Reduces portfolio volatility.

- Helps achieve goal based target value.

While, this is an excellent option, most funds barring a few, do not have this unique technique to offer investors.

Contributed by Dilshad Billimoria Certified Financial Planner and Investment Advisor who

can be reached at dilzerconsultants@gmail.com