Though ELSS provide a better alternative than traditional tax saving instruments, they have been unable to attract investors this time around.

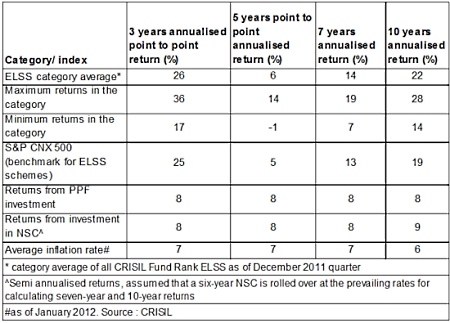

Equity linked savings schemes (ELSS) have registered 26% and 22% annualized returns over three and ten years respectively, as compared to 8-9% offered by national saving certificate (NSC) and public provident fund (PPF), shows a CRISIL study.

“The minimum three-year lock-in period for ELSS provides the fund manager with a longer investment horizon and leads to a lower portfolio churn. This also reduces the transaction costs for investors,” states the report.

The ELSS AUM is Rs. 23,998 crore (February 2012 figures). These schemes mopped up Rs. 273 crore in February, while redemption stood at Rs.402 crore resulting in net outflow of Rs. 129 crore. Industry experts have pointed out that the availability of other tax saving instruments such as tax-free bonds has resulted in low demand for ELSS this year.