SEBI has asked fund houses to disclose total expense ratio (TER) of each scheme on a daily basis.

With this, fund houses will have to introduce a separate tab called ‘Total Expense Ratio of Mutual Fund Schemes’ on their website in a downloadable spreadsheet, directed SEBI.

In a circular, SEBI said that they have observed frequent changes in TER in MF schemes and such changes are not prominently disclosed to investors. “In order to bring uniformity in disclosure of actual TER charged to mutual funds and to enable the investor to take informed decisions, AMCs shall prominently disclose on a daily basis, the TER of all schemes under a separate head on their website in a downloadable spreadsheet,” said SEBI.

Fund houses will now have to intimate investors by sharing a notice through email or SMS at least three working days prior to making any revision in TER of the scheme. In addition, fund houses are required to put such a notice of change in base TER on their website prominently.

So far, fund houses have been disclosing change in TER on their website within two working days of making such changes.

Fund houses will have to inform the board of directors of the AMC about the revision in TER along with the rationale for their decision.

The circular has come into effect immediately for new schemes and from March 1, 2018 for existing schemes.

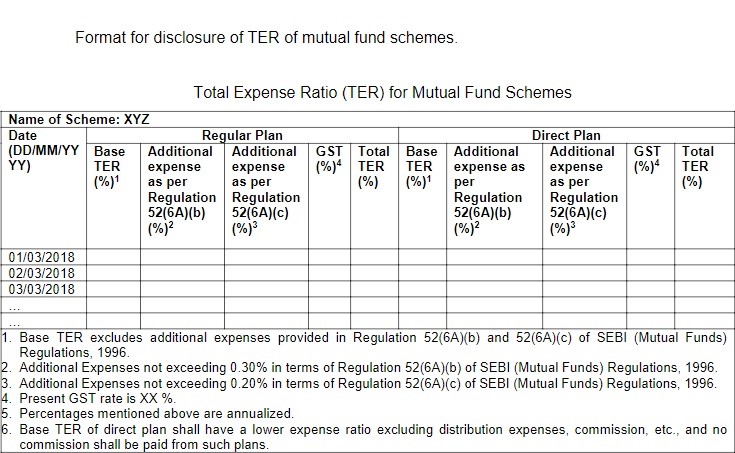

Another key development is the change in the format of TER disclosure on a scheme information document (SID). Here is the new format of disclosing TER on SID.