AMFI has asked AMCs to process switches the same way they process redemptions from June 1, 2012.

In its latest best practices circular issued on 15 May 2012, AMFI has asked fund houses to reject redemption or switch-out requests if they have not realised money in their scheme accounts, from June 1, 2012.

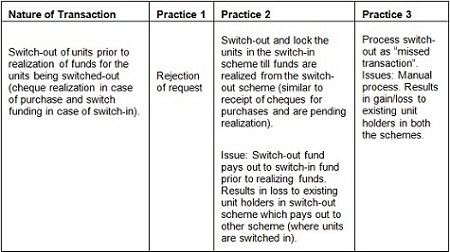

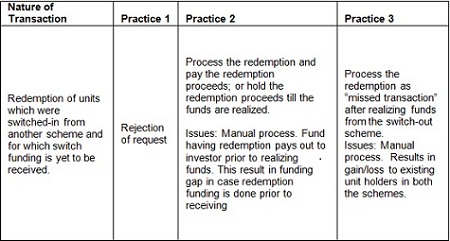

Currently, AMCs follow different practices. The circular brings in uniformity on how AMCs should treat switch-out or redemption requests when they have not realised funds in their scheme accounts.

For instance, A invests in a liquid fund on Monday and requests to switch out to an equity fund on Tuesday. This way, A earns returns for one day when the AMC has not yet received the funds. Fund houses usually receive money on the third or fourth day. These returns in effect are being paid out by existing investors.

“If you invest in an equity fund on Monday, we give the same day’s NAV. The money is realised only on Thursday. Some investors give a switch-out request on Tuesday from an equity to a liquid fund. The source fund (equity fund) makes the payment to the liquid fund (switch-out fund) without realising funds. Then investors exit out of the liquid fund on the third day (Wednesday). This latest AMFI circular says that all switch-outs should be done only after realisation of funds. Now, you can’t redeem unless the money is realised by the AMC. Earlier, a few investors were earning returns from these switch-out requests. The new rule will help the industry,” says a CEO of a mid-sized fund house.

AMFI has asked AMCs to process switches the same way they process redemptions. (For example on T+3 basis in case of equity funds). The above recommendations were given by AMFI’s Operations and Compliance Committee.

The circular cites the following practices followed by AMCs