While oil exporting nations are benefiting from higher oil prices, oil importers face growing crude import bills that affect government finances.

India, the world's third-biggest oil consumer, has been over the past two months battered by high crude oil prices that have sent retail petrol, diesel and LPG rates to record high, posed inflationary risks and together with a sliding rupee threatened to upset its current account deficit. The unwelcome combination of rising oil price and a weakening rupee is giving a tough time to investors, especially when the whole world is looking towards India as a 'growth engine'. Let's look at how crude oil slide disturbs India's macro math.

Import-led inflation in India:

The Reserve Bank of India (RBI) inflation forecast model broadly estimates that a 10% increase in oil prices pushes up inflation by 20 basis points. There are two forces at play. Higher oil prices feed into input costs across the economy while they also have a smaller disinflationary impact because of lower aggregate demand.

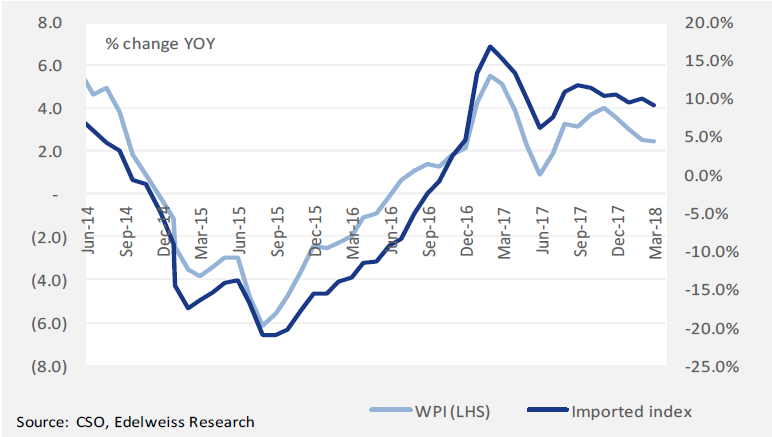

According to Edelweiss analysis, the impact of a USD 10/bbl rise in crude prices would push up headline CPI higher by 30-40bps, annually. However, the impact of higher crude oil & commodity prices is much more pronounced on the wholesale price index. As is evident in the chart below, at a time when crude (commodity) prices dropped (FY14- FY16), WPI was deep in negative as the WPI imported index witnessed a double-digit decline. An uptrend in manufacturing WPI implies higher input prices, which could eventually translate into higher output prices; pushing up core-WPI.

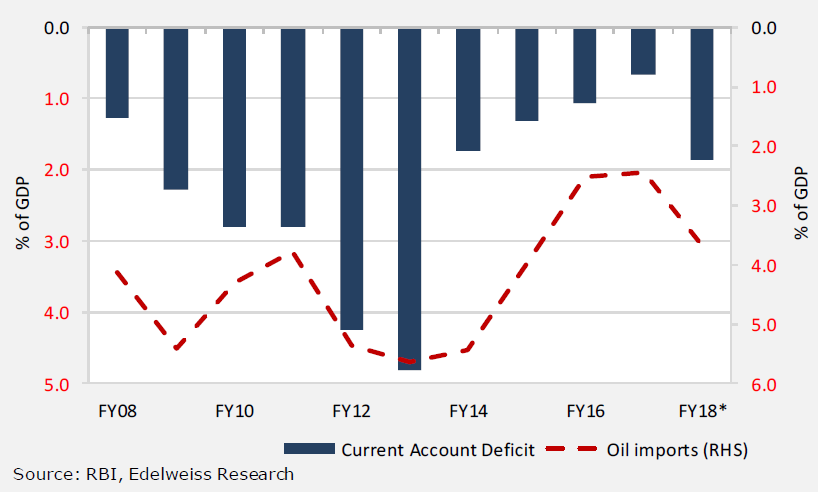

Higher oil imports adversely affect the CAD

Current Account Deficit (CAD) is another concern for Indian Economy. Given that, oil imports make up ~1/3rd of India's total import bill, higher oil prices translate into widening CAD. When oil prices surge by USD 10/bbl, India's oil import bill deteriorates by ~USD 17bn and the CAD widens by USD 10-12bn, according to Edelweiss analysis.

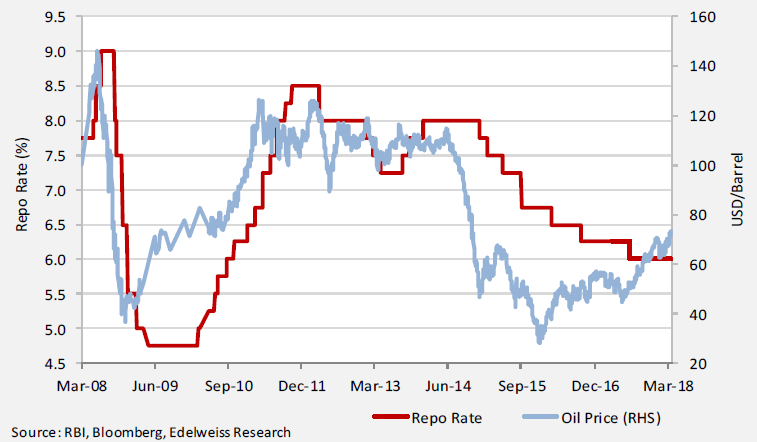

Movement in oil prices has influenced G-sec yields in a major way:

Since late 2013 & start of FY14, oil prices have influenced G-sec yields significantly. While historical correlation between G-sec yields and oil prices was absent, it is observed that ever since India adopted flexible inflation targeting, yields have reacted to CPI readings and crude oil prices. The correlation b/w oil & benchmark G-sec yield since FY14 stands at a robust +63%. The chart below depicts the trend in both.

Oil prices => Higher Inflation => Markets factor-in Higher Rates, Yields

Conclusion

The crude oil cycle has come a full circle for India in ~5Y – after having collapsed to multiyear lows of USD 28/bbl, at the start of 2016, the oil price trajectory reversed; soaring to USD 86/bbl at the start of Sep/Oct 2018. As of today, the price of oil has stabilized below $60/bbl. While India derived significant economic benefits from the low oil price levels, these benefits are all set to reverse as the trajectory is slowly taking a U-turn. To curb this, GOI is taking counter measures which include allowing 100% FDI in many segments of the sector, including natural gas, petroleum products, and refineries, among others. These will prove beneficial in the long run considering India’s energy demand in comparison to global energy demand is expected to rise to 11% in 2040 from 5.58% in 2017.