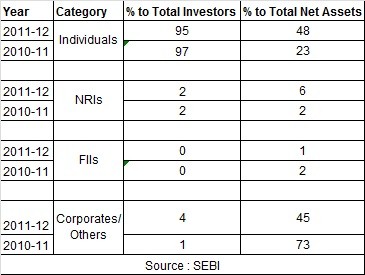

SEBI data shows that net assets of retail investors went up to 48% in FY12 compared to 23% in the previous year.

Despite a dip in equity folios and decline in markets, retail investors share in mutual funds has seen a rise from 23% in FY11 to 48% in FY12.

“Unit holding pattern data of mutual funds for 2011-12 shows considerable improvement in the share of retail investors in the net assets of mutual funds. Individual investors accounted for 95% of the total number of investors’ accounts and contributed 48% to total net assets compared to 23% of total net assets a year ago,” says a SEBI report.

Corporates constituted 3% of the total number of investor’s accounts, contributing 45% of the total net assets in the industry. Corporates majorly invest in debt schemes. Debt funds constitute 71% of the total assets in the industry.

Equity, gold ETFs and overseas fund of funds recorded net inflows in FY12. The SEBI report shows that equity schemes garnered net inflows of Rs 121 crore in FY12 while in FY11 there was a net redemption of Rs 13,138 crore. The BSE Sensex has dipped 9% from 19,136 in April 2011 to 17,404 in March 2012.

Gold ETFs garnered Rs 3,646 crore in 2011-12. In FY11, gold ETFs mopped up Rs 2,249 crore. Fund of funds investing overseas collected Rs 102 crore in FY12 as against a net redemption of Rs 907 crore during 2010-11. Net outflows dropped from Rs 49,406 crore in FY11 to Rs 22,024 in FY12.

Decline in equity folio count

Equity mutual fund folios which constitute a major chunk of retail investors are declining due to a variety of reasons including scheme mergers, folio consolidation and redemptions. Equity folios dipped to 3.76 crore in March 2012 from 3.92 crore the previous year. Fund officials say that declining folios does not necessarily imply investor exodus. In its August 22 circular, SEBI had asked AMCs to de-duplicate their folios which too is a factor in shrinkage of folio count.

Fund officials say there has been a clear shift of retail assets from equity to debt. “Retail assets have moved from equity to fixed income due to risk aversion. Investors have not made money in equity funds over the last two-three years. A lot of money is chasing debt incrementally. Yields on one year papers have been attractive which is coming at a negligible risk,” said D Ramanathan, Sr. VP & National Head – Sales & Distribution, Motilal Oswal Mutual Fund.

The report shows that mutual fund assets constitute 6.6 % of GDP, relatively low compared to other emerging market economies.

Public vs. Private

SEBI’s report also shows that private sector MFs hold 66% of folios as compared to public sector AMCs which hold 34% folios. “The private sector mutual funds managed 82.4% of the net assets as against 17.6% of net assets managed by public sector mutual funds. While individual investors held 51.2% of the net assets in public sector mutual funds, their share in private sector mutual funds was 47.4% as on March 30, 2012,” states the report.

Unit

Holding Pattern of All Mutual Funds as on March 30, 2012