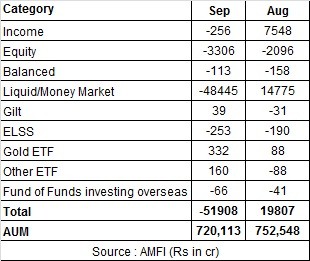

Barring gilt, gold ETFs and other ETFs, all other categories recorded redemptions, shows AMFI data for September

The recent market rally has spurred investors to exit equity mutual funds. Equity funds recorded a high net outflow of Rs 3306 crore in September. Equity funds had witnessed net outflow of Rs 2,096 crore in August, Rs 804 crore in July, Rs 186 crore in June and Rs 455 crore in April. The only positive net inflow in recent months was in May at Rs 506 crore.

Barring gilt, gold ETFs and other ETFs, all other categories recorded redemptions. Liquid funds recorded the highest outflow of Rs 48445 crore due to quarter end redemptions from companies and banks.

The industry’s AUM fell 4% from Rs 7.52 lakh crore in August to Rs 7.20 lakh crore in September. However, the 1378 points gain in Sensex in September helped industry’s equity AUM shoot up 6% from Rs 1.53 lakh crore in August to Rs 1.62 lakh crore in September.

The net outflow for September stood at Rs 51908 crore compared to a net inflow of Rs 19,807 crore in August. In September only 22 close-ended income funds were launched which mopped up Rs 1,642 crore.

Net inflow/outflow