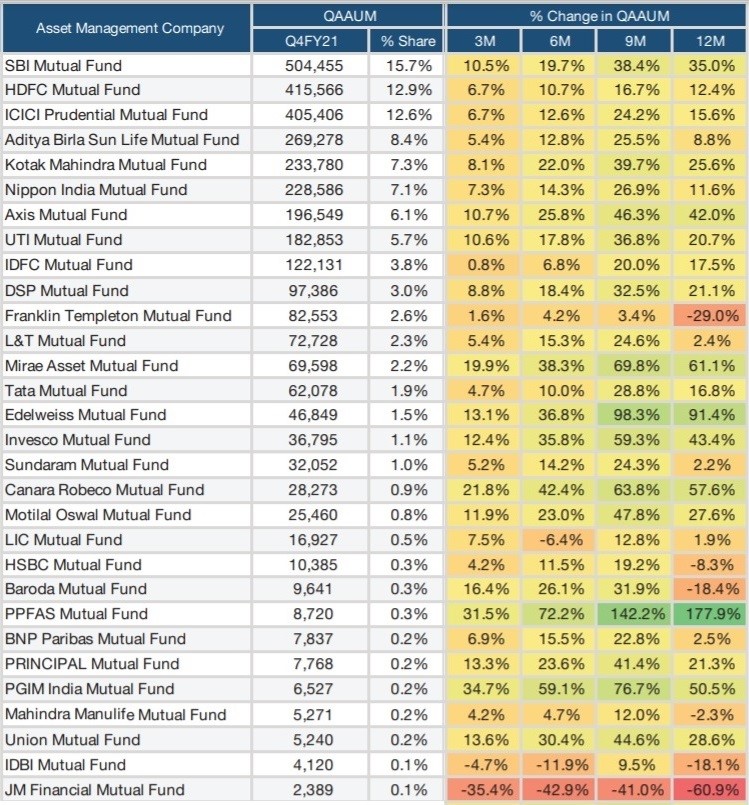

PPFAS MF is the fastest growing major mutual fund house in India. Among the top 30 AMCs, PPFAS registered the highest AUM growth at 178% in FY 2021. Its AUM went up from Rs 3,138 crore to Rs 8,720 crore during the financial year.

However, the AMC’s share in total industry AUM still remains below 1%.

With 91% growth in AUM, Edelweiss MF occupied the second spot in the list of fastest growing AMCs. The assets of the fund house increased from Rs 24,472 crore at the end of FY 2020 to Rs 46,849 crore at the end of FY 2021.

Mirae Asset MF's AUM grew by 61%, the third highest among the top 30 MFs. Its AUM went up from Rs 43,200 crore to Rs 69,598 crore.

Canara Robeco MF and PGIM India MF were the other two in the top five list. They registered an AUM growth of 58% and 51%, respectively.

SBI MF, despite being the largest fund house, saw 35% growth in assets. The growth percentage is highest among the top five fund houses and second highest among the top 10.

With 42% rise in AUM in FY 2021, Axis MF registered the highest growth among top 10 AMCs.

JM Financial MF, Franklin Templeton MF and Baroda MF saw the steepest decline in AUM. JM Financial MF's assets were down 61% at the end of March 2021 as compared to the same day last year.

Franklin Templeton MF and Baroda MF saw 29% and 18% decline in AUM.