Now, debt fund managers can’t take risk beyond a pre-defined level set by themselves. SEBI has introduced a new system that would define the maximum risk that a debt fund manager can take.

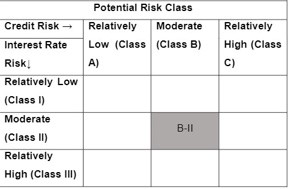

With this, the market regular has introduce 9-level matrix titled potential risk class (PRC) which is based on interest rate risk (measured in terms of Macaulay Duration) and credit risk (measured by credit risk value) of the scheme.

While Macaulay Duration is the time taken to recover the real cost of a bond measured in terms of years by calculating the present value of future cash flows (interest and principal), credit risk value is the credit rating of a debt instrument.

To make things simple, SEBI has introduced weighted average method to measure average interest rate risk of a scheme based on its Macaulay Duration. The regulator has introduced three classes which will be placed on the rows of matrix.

- Class 1 where Macaulay Duration is ‘less than or equal to 1 year’ (Can buy individual debt instruments with maturity of up to 3 years)

- Class 2 represents Macaulay Duration of less or equal to 3 (Can buy individual debt instruments with maturity of up to 7 years)

- Class 3 can have any Macaulay Duration and can hold papers across maturities

Similarly, SEBI has classified another three classes based on weighted average credit ratings of debt instruments. This will be located on the columns of the matrix.

- Class A will have credit rating value of more than and equal to 12. G-sec, state development loans, Repo on government securities, cash and AAA rated papers fall under this

- Class B reflects credit rating value of more than or equal to 10. Funds falling under this will have to hold debt papers having rating of AA+ and AA

- Class C can hold lower rated papers

|

MaxCredit Risk of scheme→ |

Class A(CRV >=12) |

Class B (CRV >=10) |

Class C (CRV <10) |

|

Max Interest RateRisk of the scheme ↓ |

|||

|

Class I: (MD<=1 year) |

Relatively Low Interest Rate Risk and Relatively Low Credit Risk |

Relatively Low interest rate risk and moderate Credit Risk |

Relatively Low interest rate risk and Relatively High Credit Risk |

|

Class II: (MD<=3 years) |

Moderate interest rate risk and Relatively Low Credit Risk |

Moderate interest rate risk and moderate Credit Risk |

Moderate interest rate risk and Relatively High Credit Risk |

|

Class III: Any Macaulay duration |

Relatively High interest rate risk and Relatively Low Credit Risk |

Relatively High interest rate risk and moderate Credit Risk |

Relatively High interest rate risk and Relatively High Credit Risk |

Here is details of matrix:

Overall, schemes falling under Class I and Class A will be least risky and the scheme falling under Class III and Class C will have highest risk.

Here is how scheme disclosure looks like:

In the above picture, the scheme fall under Class II and Class B, which indicates that the scheme offers moderate interest rate risk and credit risk.

This additional disclosure along with risk-o-meter will come into effect from December 1, 2021.