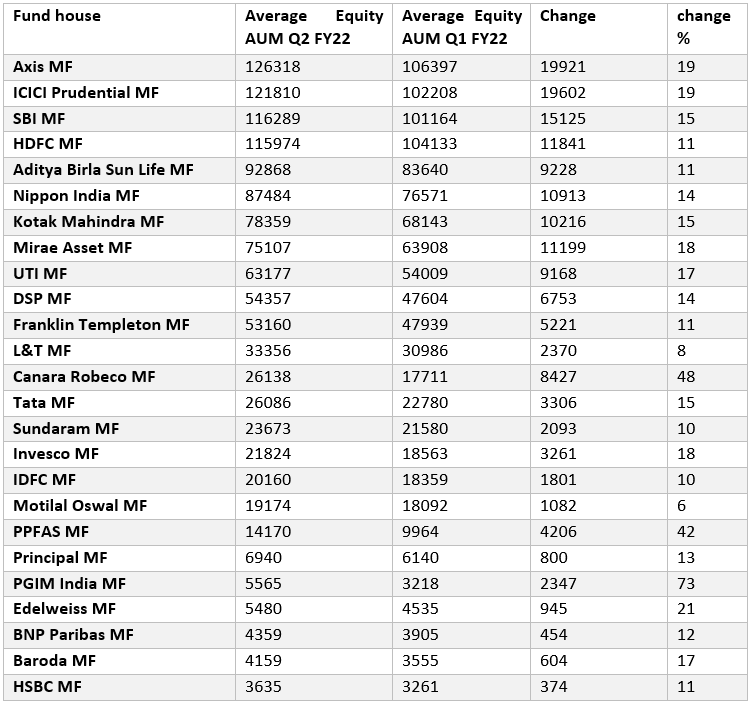

Axis, ICICI Prudential and SBI are the top three mutual funds in the equity space. HDFC MF, which slipped from the top position to the second spot in the June quarter, tumbled further to occupy the fourth spot in the second quarter of FY 2022, shows an analysis of equity AUM data.

Axis Mutual Fund’s average equity AUM surged 19% during the July-September period to rise to Rs 1.26 lakh crore. With a similar rise, second-ranked ICICI Prudential MF reported an equity AUM of Rs 1.21 lakh crore. The fund house was at the third spot in the June quarter.

Equity AUM includes pure equity schemes and ELSS.

SBI MF climbed one spot in the rankings to reach the third spot. Its AUM went up 15% to Rs 1.16 lakh crore.

HDFC MF reported a substantial rise in AUM at 11% but it was much lower than the surge reported by other top players, resulting in its fall in the equity rankings.

PGIM India reported the highest growth in equity AUM. Its equity assets went up by 73% to Rs 3,218 crore from Rs 2,347 crore. Canara Robeco and PPFAS reported the next best surge in equity AUM at 48% and 42%, respectively.

Average equity AUM of top 25 players: