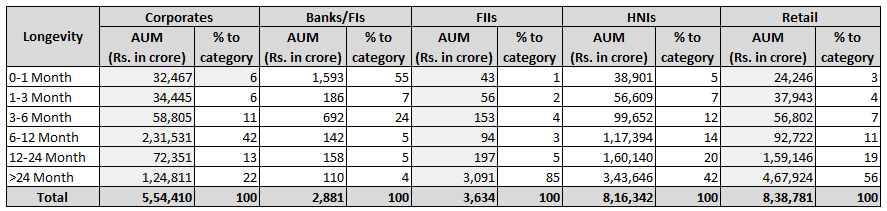

An age-wise analysis of AUM shows that over half of retail equity assets have been invested for over 2 years.

AMFI data shows that of the total retail equity assets of Rs.8.38 lakh crore, Rs.4.67 lakh crore has been invested for over 2 years. Anand Vardarajan, Business Head - Banking, Alternate Products & Product Strategy, Tata Asset Management said, “Retail book has largely grown on the back of healthy SIP growth and that usually has more longevity.”

On the other hand, 42% of the total HNI assets has been invested for over two years. Guwahati MFD Rajesh Sarawgi said, “Many HNIs have booked profits during the bull run and invested proceeds in other avenues.”

To this, Mumbai MFD Sadashiv Arvind Phene added, “Many HNIs primarily prefer the STP mode of investing as against investing in equity funds directly.”

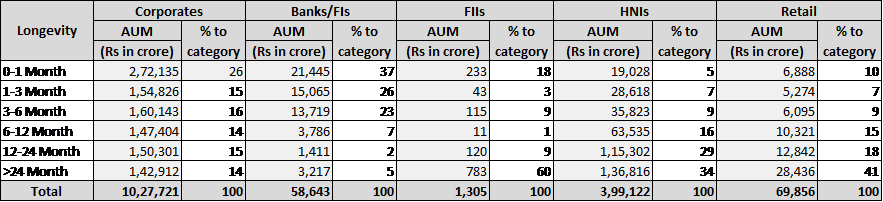

Debt schemes

Of the total retail debt assets of Rs.70,000 crore, Rs.28,436 crore (41%) have been invested for over 2 years.

An analysis of the HNI asset base shows that 34% of assets or Rs. 1.37 lakh crore have stayed invested for more than two years. As against the last year, there is an increase of 5%. Commenting on the debt categories specifically, Arvind Chari, CIO-Quantum Advisors said, “HNIs typically look at the roll down debt funds strategies as a wealth management product for its tax benefits and ability to generate better yields. The rise in investments in such funds could probably be one of the reasons.”