Listen to this article

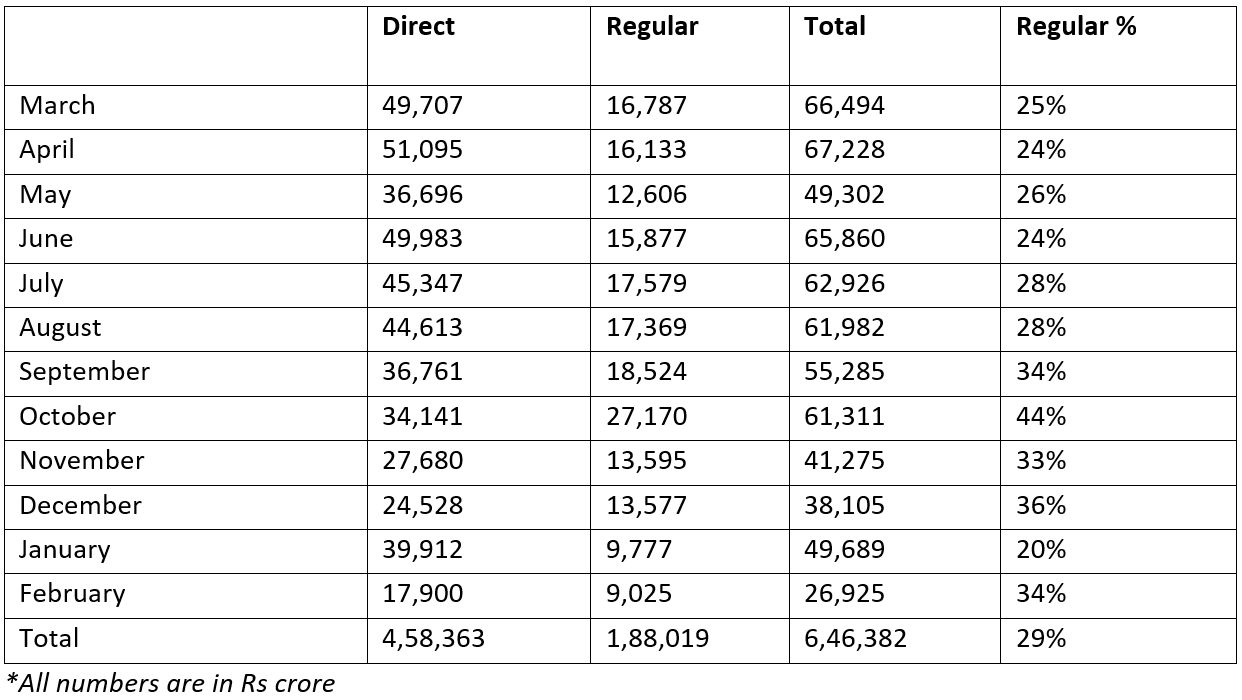

In the debt fund space, 29% of the monthly inflows come through distributors, shows an analysis of inflow data of the last 12 months (March 2021 to February 2022). The rest 71% inflows go into direct schemes.

The data is not representative of the whole industry. The figures have been sourced from a CAMS report which captures data of only CAMS serviced AMCs. Also, liquid and overnight funds are not part of the report.

Inflows through distributors was comparatively stronger in the later period as against the first few months. In the first six months (March to August), regular schemes accounted for 24-28% of the total gross inflows. The share went up to around 29-44% post August.

Debt fund inflows (plan wise):

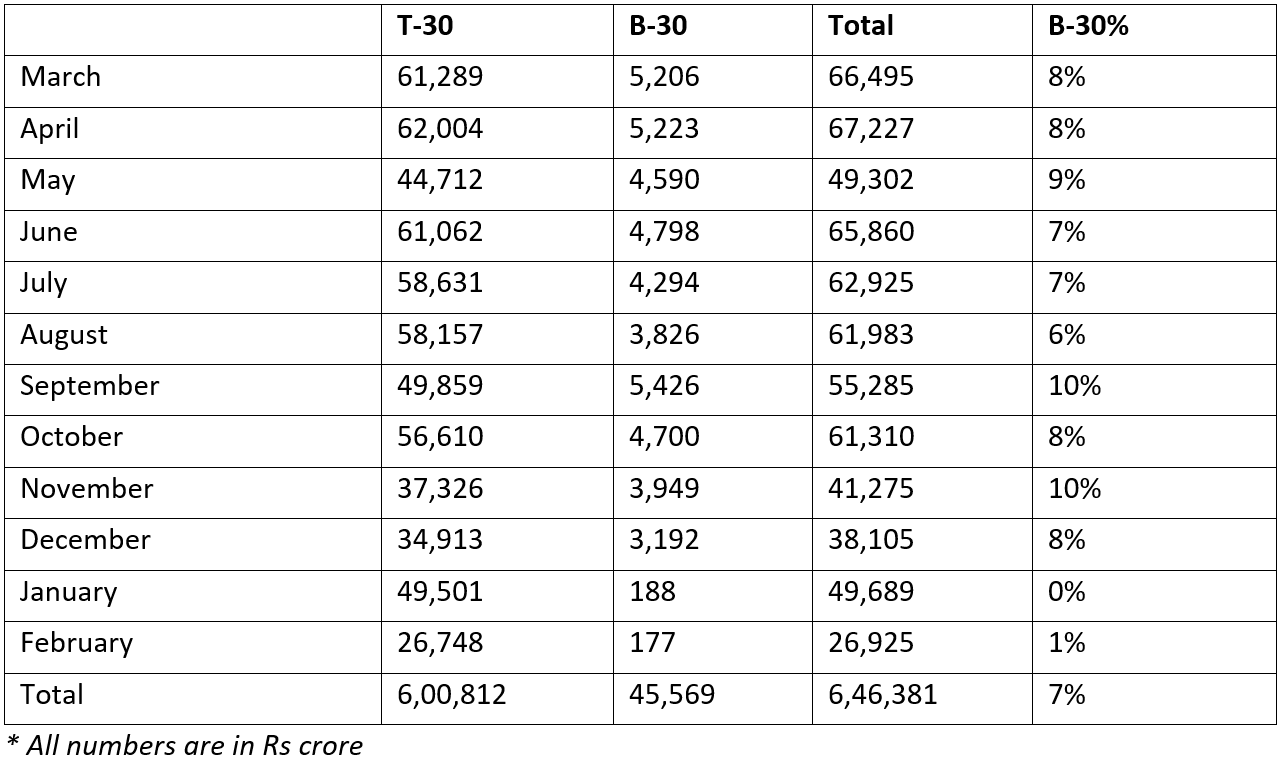

Inflows from B-30 locations dry up

In 2022, debt fund inflows from B-30 locations has been miniscule. In the first two months, B-30 areas contributed only Rs. 365 crore to the total gross collection of Rs. 76,614 crore, shows the CAMS report.

B-30 locations generally contribute less than 10% to the gross inflows in debt schemes. Their contribution hovered around 8% from March 2021 to December 2021 and plunged to less than 1% in January 2022.

Debt fund inflows (location wise):