The interest in mutual fund distribution business peaked in FY2022 after remaining subdued in the previous two financial years due to suspension of physical exams by NISM (considering the covid situation) and a ban on upfront commission.

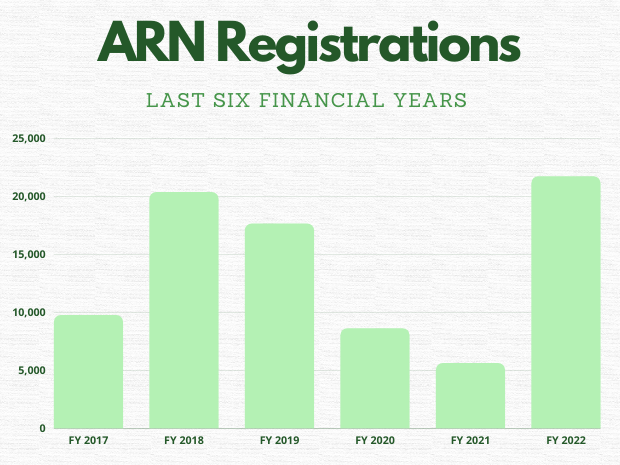

AMFI data shows the MF industry has added 21,700 individual MFDs in FY 2022 as against 5,601 in FY 2021. Overall new ARN registrations (including corporates and their employees) jumped from 16,119 in FY 2021 to 42,399 in FY 2022.

Industry insiders say the surge in ARN registrations is due to a rise in demand for mutual funds.

“People are finding the industry attractive due to a buoyancy in the market. There is a lot of demand for mutual funds but not enough MFDs. So, definitely more people will join,” said DP Singh, CBO, SBI Mutual Fund.

“The trend shows that there is a high lateral demand for mutual funds across the country including tier-II and tier-III cities. LIC Mutual Fund brought in a lot of people into the business by empanelling LIC agents,” said Lav Kumar, Zonal Head West, LIC Mutual Fund.

Raghav Iyenger, Chief Business Officer of Axis Mutual Fund, said the uptrend in ARN registration is a result of several factors. "Firstly, MFs have now become an in-demand product. Secondly, the industry is putting in a lot of efforts to add new partners. Finally, a lot of new registrations are coming from B-30 locations due to the attractive commission structure,” he said.

The new ARN registrations in the last financial year is the highest in at least the previous six financial years. FY 2018 is the only other financial year in the near-term when individual ARN registrations crossed the 20,000 mark.

Interestingly, the individual ARN registrations witnessed a consistent month-on-month growth in FY 2022. From 1,110 registrations in April 2021, the figure went up to 2,008 in December and 2,518 in March 2022.

ARN renewals also on the rise

The data shows that individual ARN renewals was around 50% higher in FY 2022 compared to FY 2021. In the previous financial year, 30,623 individual ARNs were renewed as against 20,709 renewals in FY 2021.