Listen to this article

In the last year or so, there have several reports declaring the eminent demise of active funds. These reports claim that active funds in India, like elsewhere in the world, are finding it tough to beat the benchmark.

However, this belief that active funds are struggling to generate alpha may not be true. At the recently held Cafemutual Ideas Fest 2022, Vinay Paharia, CIO of Union MF, presented a counterargument against the belief.

Paharia said that these reports are based on 'snapshot' analysis and should be looked at with caution.

"There are more than 250 trading days in a typical year; however, certain investors look at funds' performance as on a single date rather than the performance across timeframes. As a result of which the analysis only accounts for less than 0.4% of the total possible outcomes," he explained.

"Such ‘single-date’ analysis fail to demonstrate funds’ performance throughout the previous years. Further, they may also be impacted by abnormal events like the market crash in Mar 2020 due to covid-19," he added.

What is the right way to analyse performances of mutual funds?

As per Paharia, analysing performance on a daily rolling basis gives a more meaningful insight. Daily rolling returns take into consideration the returns for the period ending each day.

"Our analysis using the daily rolling returns over the 1-year, 3-year and 5-year time frames show that significant number of schemes have outperformed the benchmark," Paharia said.

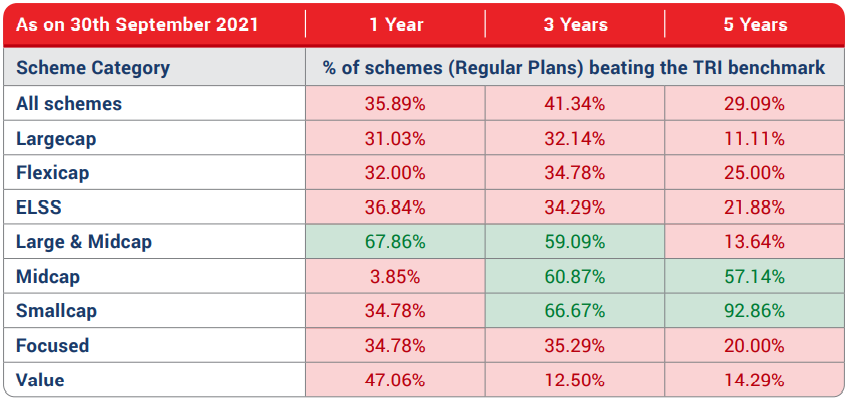

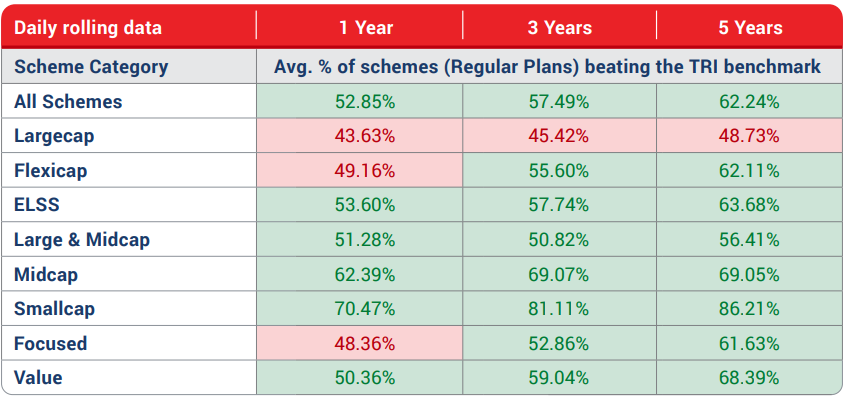

Here’s how performances look when we take different return types into account:

Performances on the basis of point-to-point return:

Performances on the basis of rolling return:

Why Indian mutual fund schemes are better at generating alpha compared to schemes in developed countries?

The reason, as per Paharia, is that there is significant dispersion among stock performances in India.

"The standard deviation is higher in the case of BSE500. This shows why the Indian market presents a better opportunity to generate alpha," he said.