Listen to this article

You have been analysing markets and managing funds for over a decade now. What have been your three key learnings during this journey?

One of the most important learnings has been to not overpay for an opportunity no matter how lucrative the narrative may sound. Secondly, focusing on the longer-term prospects of any underlying investments helps to take advantage of short-term price volatility and lastly there's an ocean of opportunities out there but it's important to define our investment universe and focus only on those ideas which we can reasonably understand and value.

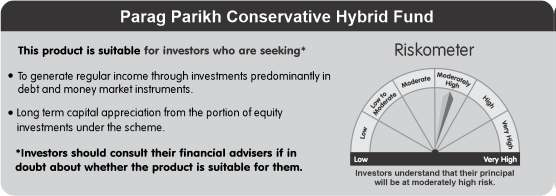

In mutual fund industry, we have products for every time frame – for instance, flexi cap funds are good for long term while fixed income funds are better for short to medium term goals. Where do conservative hybrid funds fit? Does the investor really need conservative hybrid funds?

In an investor's overall asset allocation, conservative hybrid fund can be classified as a debt allocation. If an investor has a time horizon of over three years and does not want to allocate additionally to equities then conservative hybrid fund can be a good tax efficient way to invest in debt. It provides the benefits of investing in debt securities with some additional diversification into high dividend yield equities and REITS, which provide capital payout and have the potential to appreciate capital.

Investors can also save on taxes, courtesy indexation benefits by staying invested for three plus years.

The Parag Parikh Conservative Hybrid Fund has beaten its benchmark. What are the factors that have worked well for the fund?

The Parag Parikh Conservative Hybrid Fund is quite young as it was launched in May 2021. It is a very short time frame to assess the performance of the scheme. A scheme’s performance should be evaluated at least from a three years’ perspective. However, what has helped so far is that we avoid credit risk by investing in sovereign rated debt securities and also high dividend yield equity along with REIT investments in the portfolio.

The expense ratio of Parag Parikh Conservative Hybrid Fund is one of the lowest in the category despite being a new fund. In fact, it is less than one-third of the expense ratio being changed by one of the funds. How does the fund manage to keep costs so low?

Since the returns in debt funds are usually capped by the interest rate earned from the underlying debt securities, it is important to keep the expense ratio as low as possible. Given that the fund usually intends to hold securities till maturity, the churn is quite low. The situation is same in the case of equity and REIT portfolio.

The investment approach of Parag Parikh Conservative Hybrid Fund is in contrast to its peers. For example, the fund has invested 75% of the corpus in sovereign bonds as against the category average of 36%. How do you see this divergence in investment pattern?

Since its inception, we have tried to keep credit risk as low as possible. This meant investing more in sovereign rated securities like State Development Loans (SDLs). As a result, they comprise close to 75% of the scheme holdings at the moment. We went with SDLs as their yields are relatively higher compared to AAA/AA+ rated debt securities such as corporate bonds. This allocation may change in the future if good quality AAA rated corporate bonds are available at meaningfully higher yields. To provide some additional boost to the returns over time, the scheme also invests up to 10% in REITs and up to 25% in high dividend yielding equity securities.

The Parag Parikh Conservative Hybrid Fund has a special focus on REITs and InvITs. What is the rationale behind the decision?

REITs & InvITs are a relatively new asset class in our market but are a popular asset class globally. In India, so far REITs of only commercial properties are available to invest. Investors can expect to get steady rental income from the tenants of the REIT; also, some escalation in the rental income can be expected over time. There's a chance of capital appreciation as the NAV of the REIT can increase over time. These three features of the REIT make it a relatively conservative investment option for investors seeking periodic payouts like other debt instruments. The Parag Parikh Conservative Hybrid Fund invests only up to 10% of the corpus in such REIT securities.

How is Parag Parikh Conservative Hybrid Fund different from other funds in the market? And, why should MFDs recommend it to their clients?

The Parag Parikh Conservative Hybrid Fund takes a 'go anywhere' approach to debt investments with an aim to provide reasonable returns and reduce the NAV volatility over the long run by taking as little credit risk as possible. The plan is to provide investors with a regular income from the underlying debt instruments at a reasonable cost.

Disclaimer: Investors are requested to note that the above views expressed basis on interview questions only. Investors should not consider the same as investment advice by PPFAS Mutual Fund. Please consult your financial advisor for more detail for financial planning. Mutual Fund investments are subject to market risks, read all scheme related documents carefully.