Listen to this article

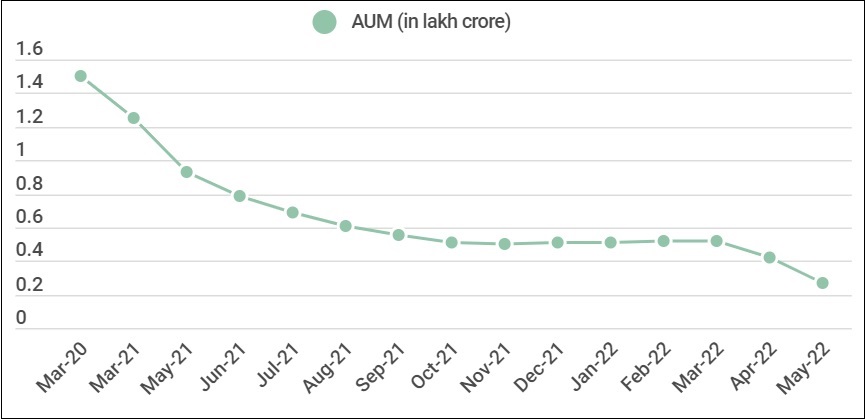

FMPs have been losing sheen for quite some time now. Its AUM went down to Rs.26,000 crore in May 2022 from Rs.93,000 crore in May 2020.

While FMPs lost sheen after the change in taxation norms in which the holding period to avail long term capital gains tax benefits was extended, volatility in the debt market due to series of credit events and interest rate changes added to its woes despite having a close end structure.

What’s the issue?

FMP is a hold till maturity product. According to SEBI norms, fund managers have to buy debt securities having maturities not greater than the fund’s maturity.

As a result, many investors invest in FMPs based on its tentative yield to maturity and exit whenever it matures to avail the benefits of indexation.

For instance, if an investor invests Rs.1000 in an FMP having maturity of 37 months and tentative yield of 6.5%, she would get close to Rs.1210 at the end of 37th month irrespective of movement in NAV during the interim period.

While investors can sell units of FMPs through exchanges, they hardly find any takers.

Overall, FMP does not get impacted due to interest rate changes if held till maturity. However, NAV of FMPs is not immune to such changes. It can be greater and lower than its NAV declared on the very first date of the allotment.

How is NAV of FMP computed?

Total corpus collected by FMP at cost + interest accrued/earned - expenses +/- Marked-to-market adjustment)/no of units allotted

Barring total corpus, all three components – interest accrued, mark to market and expenses are calculated on daily basis.

As a result, NAV of FMPs decreases when interest rates go up and vice versa.

While the current NAV calculation does not have any problem as it reflects intrinsic value of bonds, many investors – be it retail, HNIs or corporate do not want to see notional loss in fixed income portfolio.

This notional volatility has significant impact on corporates as it affects their books and thereby their bottom line. No corporate wants to report negative income on their fixed income investments as these investments are held till maturity. Hence, majority of them are moving to debt products which follow amortisation method to reflect the current market value i.e. they buy debt securities directly from RBI platform.

The solution

According to IND AS (Indian Accounting Standards) , an investor (corporate) may hold many interest-bearing securities in an investment portfolio with an intent to hold such securities till their maturity and such securities can be accounted at amortized cost only if it meets these two criteria:

- ‘Hold-to-collect’ business model test - Objective is to hold the financial asset in order to collect contractual cash flows;

And

- ‘SPPI’ contractual cash flow characteristics test - Contractual terms give rise to cash flows that are Solely Payments of Principal and Interest (SPPI) on the principal amount outstanding.

Currently, g-sec, term deposits and trade receivables follow these standards to disclose the current market value of securities.

Basically, the simple yet effective solution is disclosing two NAVs. The first can be based on the current practice i.e. by factoring in marked-to-market movements and other could be based on amortisation method suggested by IND AS.

Let’s us look at it with the formula:

Additional way to declare NAV

Total corpus collected by FMP at cost + interest accrued/earned - expenses)/no of units allotted. Here NAV may not be volatile and it would reflect the actual value of NAV on daily basis. Of course, MFs will have to align their accounting process based on amortization method.

This way, there will be no negative impact on NAV of FMPs due to market movement provided these are held under amortization.

If both types of NAVs are declared on a daily basis, an investor will have an option to choose based on her needs or accounting/business policy.

Do you like this idea? Do share your views through comments.