Listen to this article

Alpha is not something we ideally expect from passive funds. But is it impossible to get above-market returns through passives? Interestingly, not. There are several passive strategies which can help your clients get market-beating returns.

At the recently held Cafemutual Passives Conference 2022, Vikash Wadekar of Motilal Oswal MF shared with us some intriguing passive and passive+debt strategies that have the potential to generate alpha. Let us take a look at them one-by-one.

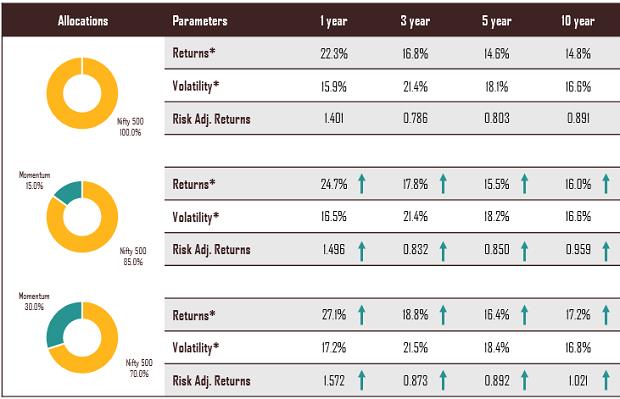

Strategy 1 (Mixing Nifty 500 and Momentum):

According to an analysis done by Motilal Oswal MF, use of smart beta passive funds along with an index fund can lead to 'better than market' returns.

For example, a portfolio with 15% allocation in a momentum fund and the rest 85% in Nifty 500 would have delivered 17.8% return in 3-years' time compared to 16.8% return in the case of total allocation to Nifty 500. The return goes up further if allocation to momentum is raised to 30%. The best part is that volatility remains the same in all the three cases.

The study has uses past data (as on 31 March 2022) to test the strategy.

Nifty 500 = Nifty 500 TRI, Low Vol = S&P BSE Low Volatility TRI. Data as on 31-Mar-2022

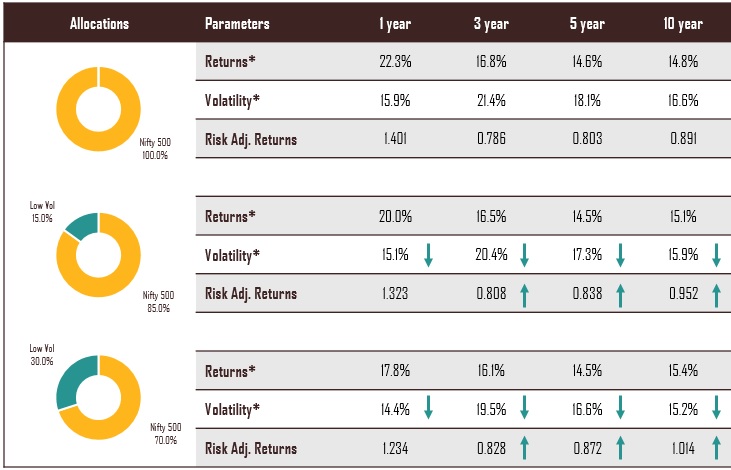

Strategy 2 (Mixing Nifty 500 and low volatility):

Low volatility funds have the potential to bring down overall volatility of the portfolio without hurting returns. The study shows that 15% exposure to low volatility would have brought down volatility from 21.4% to 20.4% in a 3-year period compared to a total allocation to Nifty 500. A 30% allocation to low volatility would have brought down the volatility further to 19.5%. Interestingly, the returns remain almost the same despite a significant decline in volatility.

Nifty 500 = Nifty 500 TRI, Low Vol = S&P BSE Low Volatility TRI. Data as on 31-Mar-2022

Strategy 3 (Combining low volatility and momentum):

The study compares the past returns of a low volatility + momentum (50:50) portfolio with that of Nifty 200 TRI. The combo portfolio was able to beat the index in all the time frames comfortably, while maintaining an almost similar volatility.

Performance as of close of 31-Mar-07 to 31-Mar-22 | Low Vol = S&P BSE Low Volatility TRI | Momentum = Nifty200 Momentum 30 TRI

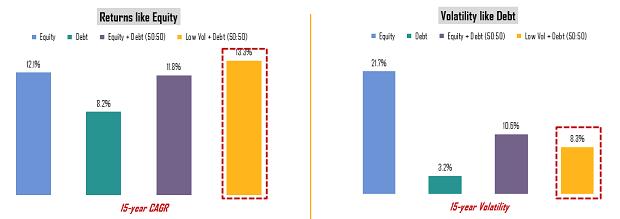

Strategy 4 (Mixing low volatility with debt):

A mix of low volatility and debt can be the right strategy for risk-averse investors looking for higher returns. The study compares 15-year CAGR of equity, debt, equity + debt (50:50) and low volatility + debt (50:50). It finds out that low volatility + debt has done better than even equity funds and that too with much lower volatility.

Performance as of close of 31-Mar-07 to 31-Mar-22 | Equity + Debt = Nifty 200 TRI + Nifty Composite Debt Index (50:50) | Low Vol + Debt = S&P BSE Low Volatility TRI + Nifty Composite Debt Index (50:50)

Here is a glimpse of Vikash’s session at CPC 2022. To get access to the entire session, write to us at newsdesk@cafemutual.com.