Listen to this article

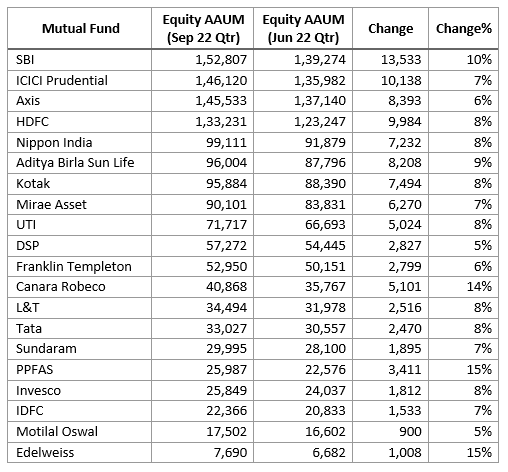

An analysis of average equity AUM for Sep 22 quarter shows SBI MF continues to stay on top with an average equity AUM of Rs. 1.53 lakh crore. Notably, the fund house reported 10% growth last quarter.

With a quarterly growth of 7%, ICICI Prudential MF replaced Axis MF to take the second spot. The fund houses have an average equity AUM of Rs. 1.46 lakh crore and Rs. 1.45 lakh crore, respectively.

HDFC MF and Nippon India MF retained the fourth and fifth spot with an average equity AUM of Rs. 1.33 lakh crore and Rs. 99,111 crore, respectively with quarterly growth of 8% each.

In absolute terms, SBI MF recorded the highest growth of Rs. 13,533 crore, followed by ICICI Prudential (Rs. 10,138 crore) and HDFC MF (Rs. 9,984 crore).

Whereas, in percentage terms, all the top 20 fund houses grew by at least 5%. PPFAS MF and Edelweiss MF reported the highest growth at 15%. Canara Robeco MF and SBI MF followed next with 14% and 10% growth, respectively.

Here is the equity ranking of the top 20 fund houses along with a comparative analysis of their performance. Figures mentioned are in crore.