Listen to this article

There are three kinds of investors — who invest in mutual funds, who have never invested in mutual funds and lastly those who were investing at a certain point of time but do not do so any longer.

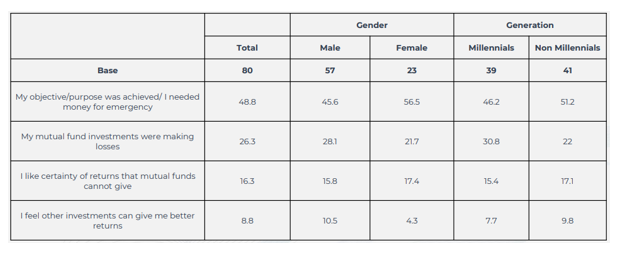

In a recently held investor survey, Cafemutual tried to find out why some people give up on mutual funds after staying invested for a certain amount of time. The ‘Rediscover the Indian Investor’ survey showed that half such investors cited two reasons to leave mutual funds — they either realised their goal or had to withdraw the money for an emergency.

Of the rest, 26% said they stopped investing after their portfolio incurred losses. 16% said they were unhappy with the fact that there was no certainty of returns. 9% said they found other investment avenues which had the potential to deliver better returns.

Interestingly, a higher percentage of millennials were alarmed by losses compared to non-millennials. The study shows that 31% millennials who stopped investing in mutual funds did so because of losses as against only 22% non-millennials.