Listen to this article

An analysis SIP data done by WhiteOak Capital MF shows that SIP date has no role to play in the long term wealth creation journey of investors.

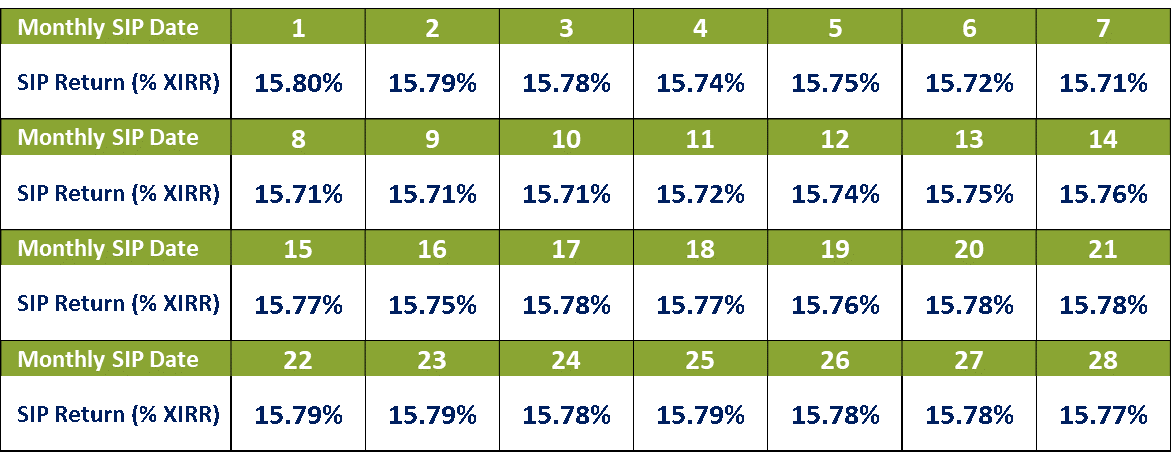

Answering common questions on the most preferred and beneficial date to start a SIP or whether the SIP amount should be split into multiple-date SIPs, the study reveals no meaningful difference between the average return of different dates’ 10 Years SIPs.

10 Years Average SIP Return (% XIRR) on Daily Rolling Basis for particular date of the month for S&P BSE Sensex TRI between Sep 1996 to Sep 2022. Past performance may or may not be sustained in future.

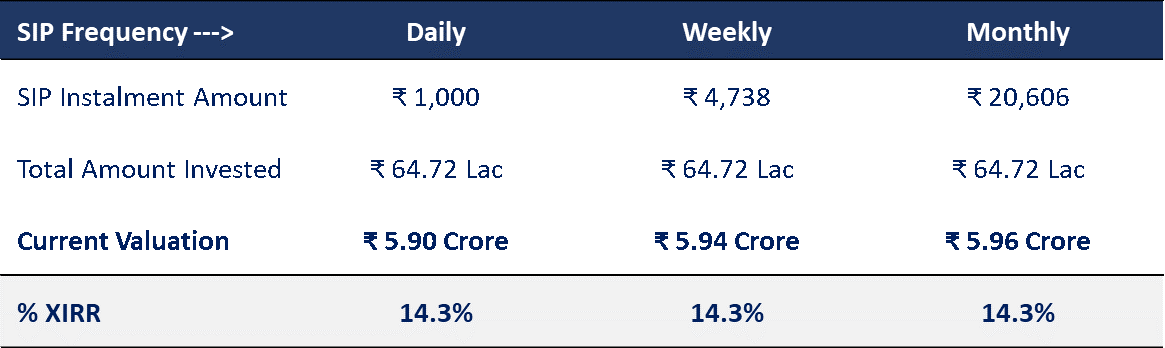

Which SIP frequency to select?

A historical data analysis suggests that it hardly matters if the investor invests via daily, weekly or monthly SIP frequency in the long term. All three frequencies end up generating somewhat similar returns (% XIRR). The key takeaway from the analysis is to focus on investing a small amount regularly for the long term.

% XIRR for S&P BSE Sensex TRI for SIP between Sep 1996 to Sep 2022. SIP installment amounts are selected in such a way, so that the total investment remains the same in all the three frequencies for better comparison. Past performance may or may not be sustained in future.

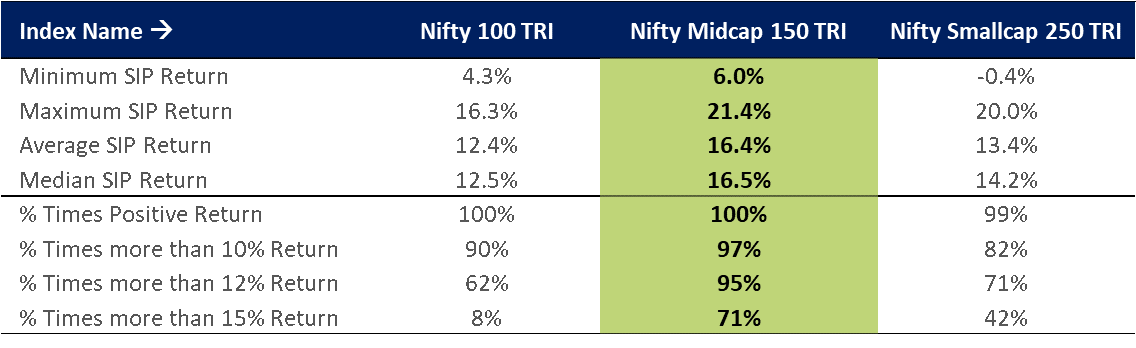

Largecap, midcap or smallcap SIP?

An average large cap stock is generally less volatile than an average small and midcap stock and provides stability to the portfolio. However, the small and midcap segments may offer many opportunities for potential higher growth in the long run. The study reveals that among the three market cap segments, the midcap segment is a good investment option for investors seeking to invest via the long-term SIP route.

For illustration purpose only. 10 Year Monthly Rolling (% XIRR) Return considered from Apr-05 to Sep-22, first observation recorded on 1-Apr-15. Past performance may or may not be sustained in future. Index performance does not signify scheme performance.

What is an ideal investment time horizon for SIP?

Equities have proved to be a volatile asset class in the past. But the study reveals volatility reduces as investors increase their investment horizon.

For illustration purpose only. Above returns are %XIRR Rolling Returns on monthly basis for S&P BSE Sensex TRI for SIP between Sep 1996 to Sep 2022. Past performance may or may not be sustained in future.