Listen to this article

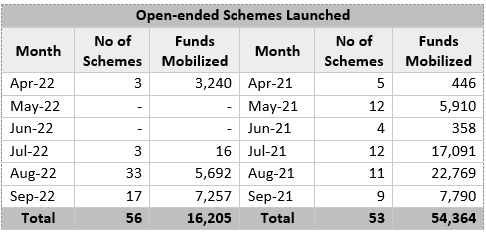

Despite launching 56 schemes during April-Sept 2022 as against 53 schemes in April-Sept 2021, the MF industry saw a massive decline in the first half of the current financial year in terms of NFO collections.

AMFI data shows that the MF industry NFO collection reduced from Rs. 54,364 crore in April-Sept 2021 to Rs. 16,205 crore in April-Sept 2022.

Attributing the decline to bumper NFOs last year, DP Singh, Deputy Managing Director and Chief Business Officer, SBI MF said, “Last year was a year of bumper NFOs. In fact, Rs. 25,000 were mobilized by two of our funds alone.”

He added, “Currently, NFOs are largely directed to complete the existing product boutique and are not mainline funds. These are new fund categories or thematic funds. In absence of mainline funds, the collections are bound to be lower as investors are not ready to commit a big amount of money at this point.”

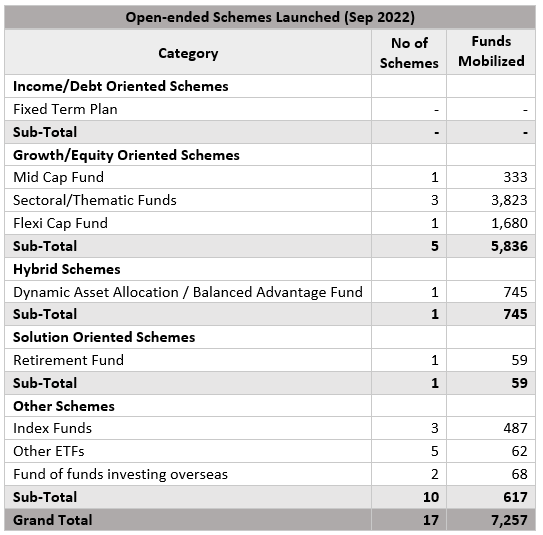

Funds mobilized in September 2022

During the current fiscal, the highest mop-up of funds was in September 2022 where 17 schemes collected over Rs. 7,000 crore.

This was largely due to growth/equity oriented schemes where WhiteOak Capital Mid Cap Fund, three sectoral/thematic funds (ICICI Prudential PSU Equity Fund, Kotak Business Cycle Fund and Tata Housing Opportunities Fund) and Sundaram Flexi Cap Fund collected Rs. 333 crore, Rs. 3,823 crore and Rs. 1,680 crore respectively.

On the passive side, three index funds and five ETFs collectively garnered Rs. 549 crore. These funds included Aditya Birla Sun Life Nifty SDL Sep 2025 Index Fund, IDFC Nifty200 Momentum 30 Index Fund, Tata CRISIL IBX Gilt Index - April 2026 Index Fund, Axis Silver ETF, HDFC Silver ETF, HDFC NIFTY Growth Sectors 15 ETF, HDFC NIFTY 50 Value 20 ETF and HDFC NIFTY 100 Quality 30 ETF.