Listen to this article

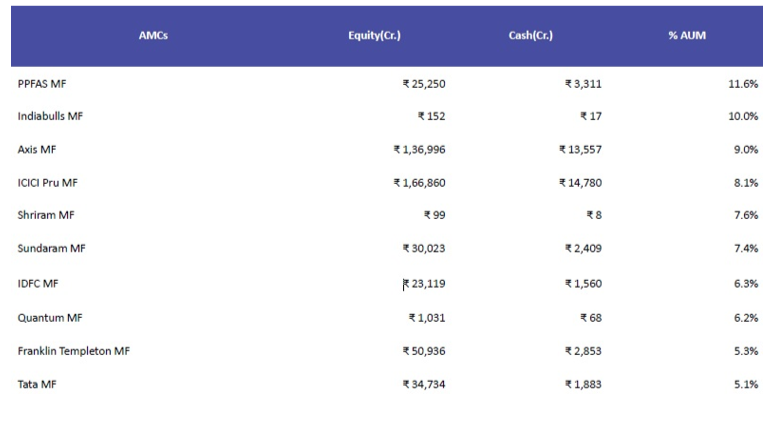

A study done by online MF distribution firm Fisdom shows that 10 fund houses hold more than 5% of their equity assets in cash.

The analysis further shows that PPFAS MF has the highest cash exposure. The fund house has kept 12% or Rs.3300 crore of its total equity assets of Rs.25,250 crore in cash.

In absolute terms, ICICI Prudential MF and Axis MF have the highest cash exposure of Rs.14,780 crore (8% of the total equity assets) and Rs.13,557 crore (9% of the total equity assets), respectively.

Fund managers are allowed to have a part of the portfolio in cash to meet redemptions or deploy funds when they see opportunities in market.

While an equity fund manager can hold up to 35% of the total assets in cash depending on the fund category (for instance, 20% in large cap funds), many fund managers keep this level below 5% to make most out of the equity growth story. However, a few managers hold higher cash component only to deploy funds at desirable valuations. So, largely it is a subjective call.

Here is the list of fund houses with highest exposure to cash and cash equivalent securities