Listen to this article

More than half of the investors are yet to start a SIP, reports CAMS. In fact, close to 57% of the investors with CAMS serviced fund houses are still without any SIP, Anuj Kumar, MD, CAMS shared this thought-provoking data at Cafemutual Confluence 2022 (CC 22).

Of the total 2.40 crore investors with CAMS serviced fund houses, 57% of investors are without SIP.

The data further reveals that close to 1 crore SIP accounts do not see any change in investment amount over the last three years.

Also, 36 lakh SIP investors have paused or discontinued over the last three years of which 21 lakh investors have not redeemed their money and 8 lakh have not restarted their SIP. These figures highlight the need for nudging clients to start/top-up their SIPs which in turn will also deepen existing investors’ wallet share.

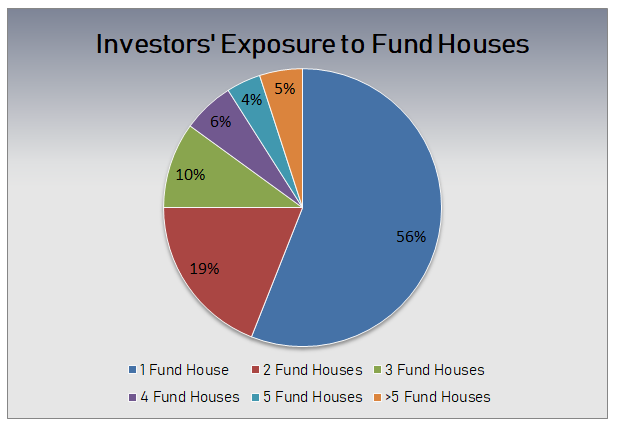

Further, more than half of investors (56%) have exposure to only one fund house. These numbers thus hint at the need to broaden existing investors’ asset allocation and diversification.

Tap the emerging investor segments

The number of millennial investors increased from 31 lakh in 2019 to 56 lakh in 2022 to form 28% of the total investor base. This is only expected to increase further and leaves us with a few introspective questions - Are we tapping the next generation of our maturing investors? Are we digitally tooled to serve this new generation? What do we do differently?

‘Women investors’ is another emerging segment. Their number has increased from 18 lakh in March 2017 to 55 lakh in March 2022.

The next emerging segment comprises ‘NRI investors’. With 85,000 new folios and over Rs. 35,000 crore of gross sales in FY 2022 alone, this segment also holds huge potential.

Identify the geographic potential

In 2017, B30 cities contributed 9% to total individual investor gross sales of Rs. 5.70 lakh crore. In 2022, their contribution rose to 22% of Rs. 9.60 lakh crore. This is nearly a two-and-a-half times rise. Also, 39% of new folios in FY 2022 are from B 30 cities.

Outside of the big cities, there are opportunities in B30 cities which need good guidance and engagement. They do have disposable income and the ability to transact and are equipped with internet and smartphones.

Here’s a teaser of Anuj’s session. You can watch the entire video along with other CC 22 videos at a nominal price of Rs. 499 only. Simply write to us at fouzia@cafemutual.com and get ready to march towards Rs. 100 lakh crore.