Listen to this article

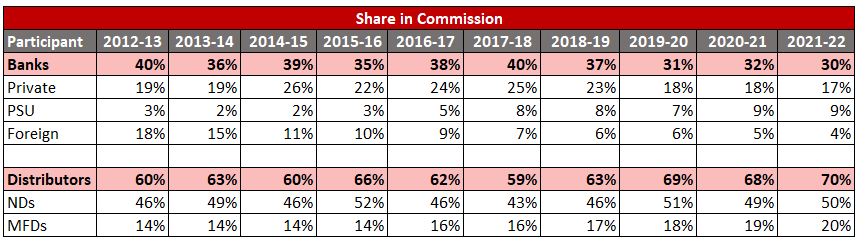

In FY 2021-22, MFDs and NDs collectively had a 70% share in the total gross commission, says a report released by Kotak Institutional Equities. Notably, this is the highest percentage share since FY 2012-13.

While the combined share of NDs and MFDs kept changing over the last ten years, it mostly hovered around 59% - 70%. On an average, it was 64% over the last 10 years.

Independently, MFDs and NDs reported 20% and 50% share in FY 2021-22, respectively.

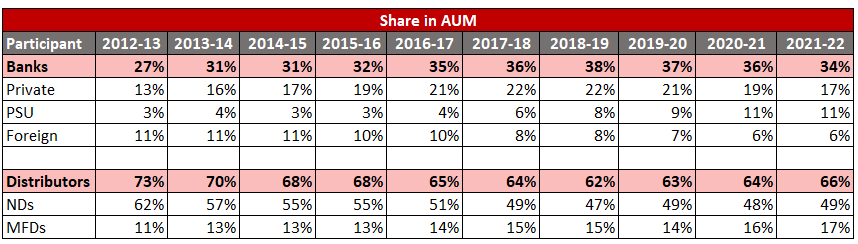

In terms of contribution to AUM, MFDs and NDs account for share of 17% and 49%, respectively. MFDs and NDs collectively formed 66% of the total AUM in FY 2021-22. While they continued to form a major chunk of the AUM, the highest share (73%) was reported in FY 2012-13.

“Mutual fund distribution in India relies heavily on national distributors (ND) with wider presence as well as the smaller agents, i.e., independent financial advisors (IFAs) who tend to be more localized. Both these categories of distributors have gained market share in terms of commissions earned as well as AUMs managed,” mentioned the report.

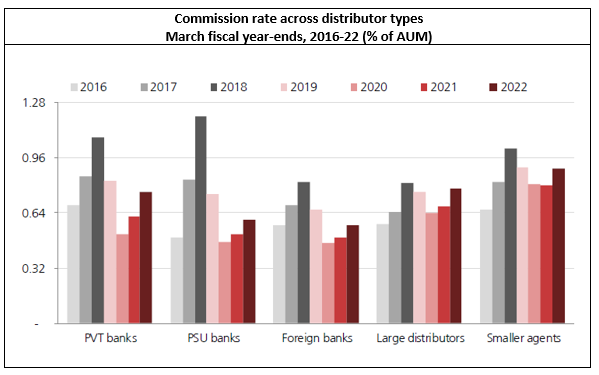

An overall comparison shows a higher share in commission than AUM in the case of banks, until FY 2017-18, which gradually declined. “We understand that before the ban on upfront commissions, banks were generally more reliant on earning upfront commissions as compared to NDs and IFAs”, explained the report.

It added, “This partly explains their higher commission share versus the AUM share pre-FY2020 and the sharper impact on their commission rates after the ban, i.e., from FY2020. Impact on non-bank distributors due to commission ban was lower as seen from a smaller decline in their commission rates after the ban compared to banks.”

Higher commission rate for MFDs and NDs hint at historically higher trail-base commission structure and higher share in recent NFO sales.