Listen to this article

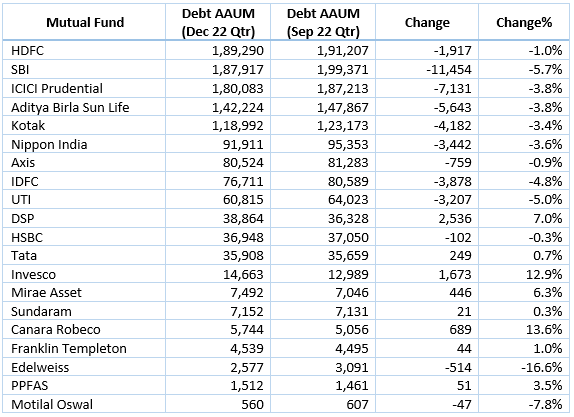

After missing the first spot by a thin margin in September 2022, HDFC MF overtook SBI MF in the last quarter, shows an analysis of the top 20 fund houses. Despite a 1% decline in the average debt AUM, HDFC MF took the lead by managing Rs. 1.89 lakh crore of debt assets.

On the other hand, SBI MF managed Rs. 1.88 lakh crore of debt assets, quite close to HDFC MF. However, SBI MF reported a 6% quarterly decline.

Notably, ICICI Prudential MF (Rs. 1.80 lakh crore), Aditya Birla Sun Life MF (Rs. 1.42 lakh crore) and Kotak MF (Rs. 1.19 lakh crore) kept a tight grip on their previous rankings. They continued to occupy the third, fourth and fifth positions.

While ICICI Prudential MF and Aditya Birla Sun Life MF saw a decline of 4% each, the average debt AUM of Kotak MF shrunk by 3%.

In fact, the overall average debt AUM of the top 20 fund houses declined by 3% due to the continuing uncertainties in the debt market. It shrunk from Rs. 13.21 lakh crore in September 2022 to Rs. 12.84 lakh crore in December 2022.

Of the 20 fund houses, only 5 reported more than 1% quarterly growth. These include - Canara Robeco MF (14%), Invesco MF (13%), DSP MF (7%), Mirae Asset MF (6%) and PPFAS MF (3%).

Here is the debt ranking of the top 20 fund houses along with their quarterly performance. Figures mentioned are in crore.

Notes:

* Average AUM in the case of Canara Robeco MF is as on January 6, 2023

* HSBC MF completed the acquisition of L&T MF in December 2022 quarter. For an apple-to-apple comparison, we have captured the total average AUM of both fund houses in September 22 quarter

* Monthly average AUM is considered where asset-wise classification of quarterly average AUM is not available