Listen to this article

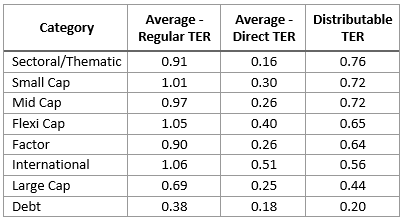

An analysis of the Cafemutual Ready Reckoner Index Fund February 2023 shows that sectoral/thematic funds have the highest distributable TER of 0.76.

Both small cap and mid cap index funds have the second highest distributable TER of 0.72. With 0.65 of distributable TER, flexi cap is the index fund category with the third highest distributable TER.

Among the index categories with lowest distributable TER were large cap and debt.

Distributable TER is the difference between regular plan TER and direct plan TER. It indicates leeway that AMCs can offer in the form of commission. While mutual funds are not bound to pay the entire distributable TER as commission, the payout is generally close to the difference in expense ratio of regular and direct plans. It also depends on volume of business generated by a distributor.

Let us look at the table to know more

Aashwin Dugal, Co-Chief Business Officer, Nippon India MF attributes this to limited number of funds in these categories. He said, “On a comparative basis, sectoral/thematic funds and small cap funds can have a greater capability. Also, another reason could be the limited number of funds in these categories.”

Lav Kumar, Zonal Head, West Retail, LIC MF points out that operating expenses and profits also form a part of TER. He said, “The payment of distributable TER as commission to distributors is a strategic decision and is also dependant on the business that a distributor generates.”

He further said, “The source of fund inflows is another factor here. If inflows are coming more from distribution then the TER supports the distributors and likewise where inflows are largely from direct plans then the direct TER is kept at a lower level.”

We analysed 69 index funds - 41 large cap, 5 mid cap, 3 small cap, 1 flexi cap, 2 sectoral/thematic, 2 international, 4 factor and 11 debt index funds by averaging out the TER details for each fund category.