Listen to this article

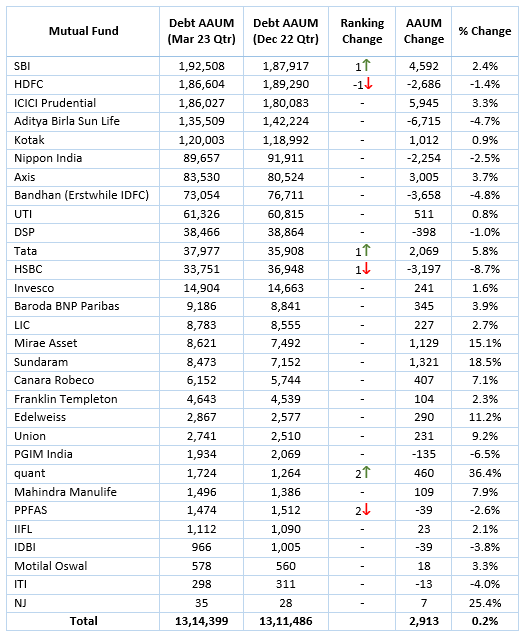

SBI MF has regained the top spot after losing it to HDFC MF in the December 2022 quarter, shows AMFI data. As on March 2023, the two fund houses respectively manage quarterly average debt AUM of Rs. 1.93 lakh crore and Rs. 1.87 lakh crore.

On the other hand, the remaining names in the top-10 list remain the same

These are ICICI Prudential MF (Rs. 1.86 lakh crore), Aditya Birla Sun Life MF (Rs. 1.36 lakh crore), Kotak MF (Rs. 1.20 lakh crore), Nippon India MF (Rs. 89,657 crore), Axis MF (Rs. 83,530 crore), Bandhan MF (Erstwhile IDFC MF) (Rs. 73,054 crore), UTI MF (Rs. 61,326 crore) and DSP MF (Rs. 38,466 crore).

In absolute terms, ICICI Prudential MF, SBI MF and Axis MF recorded the highest growth of Rs. 5,945 crore, Rs. 4,592 crore and Rs. 3,005 crore, respectively. However, quant MF (36%), NJ MF (25%) and Sundaram MF (18%) led in percentage terms.

Overall, the quarterly average debt AUM of the top 30 fund houses increased slightly from Rs. 13.11 lakh crore as on December 2022 to Rs. 13.14 lakh crore as on March 2023.

Ranking Methodology

For our analysis, we have considered the top 30 fund houses with the highest quarterly average total AUM as on March 2023.

We have ranked these 30 fund houses based on quarterly average AUM in liquid/money market /floater funds, gilt/gilt funds with 10 year constant duration and remaining income/debt oriented schemes as on March 2023.

Where the asset-wise classification of quarterly average AUM is not available, we considered monthly average AUM figures.

Debt Ranking

* Figures in crore