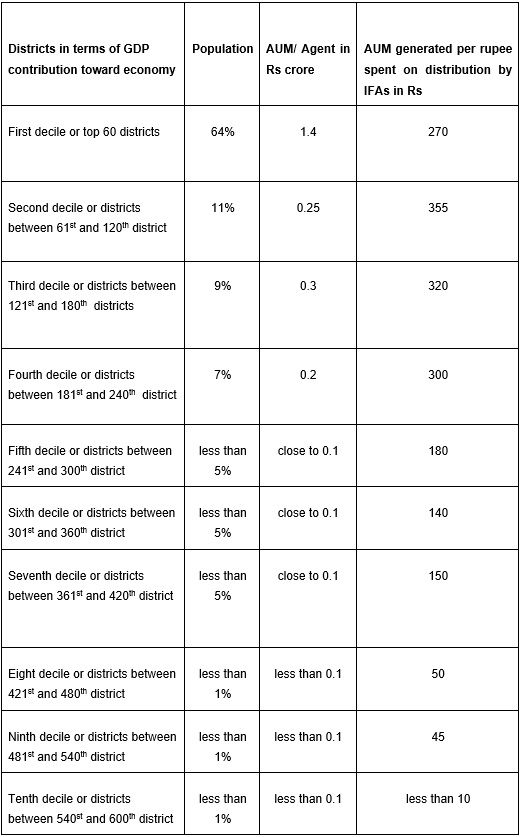

A recent study of SEBI shows that distributors active in small cities giving a larger contribution in industry AUM for a rupee spent on them in terms of distribution costs by AMCs.

Mutual fund distributors active in small cities (i.e. districts between 61st and 120th district in terms of GDP contribution towards economy) are offering bang for the buck as far as distribution costs are concerned. For each unit of a rupee incurred by AMCs as distribution cost, the distributors contribute Rs 355 in mutual fund assets in such areas, shows a recent study published by SEBI. In fact, distributors active in districts between 121st and 180th district and districts between 181st and 240th district contribute close to Rs 300 in industry AUM for each unit of a rupee spent on them.

Distributors of top 60 cities which include Mumbai, Delhi, Kolkata, Bengaluru and Chennai contribute an average of Rs 270 in AUM for each unit of a rupee spent on them.

Citing a reason behind this insight, the study says “Due to untapped potential of these districts, distribution network in second decile are 31.5% more efficient than the top decile. The corresponding figures for the 3th and 4th deciles are 21.3% and 12.3% respectively.” The top 60 districts formed the first decile followed by second decile with districts between 61st and 120th district and so on.

AUM per distributor

Distributors active in first decile or top 60 districts dominate the rest of India in terms of AUM generation. This distribution network active in such districts generated close to Rs 1.5 crore in the industry AUM as on August 2013. Even if the major contributor in AUM - Mumbai is excluded, the rest of 59 districts still dominate the remaining districts with contribution of close to Rs 60 lakh in mutual fund assets.

The study attributes this to the presence of large number of distributors in these areas. It says that 65% of all distributors including banks are located in these districts.

The study points out that districts located in sixth to tenth deciles contribute 17% to nation’s GDP having only 4% of all distributors. “Even if people in these districts would like invest their savings into mutual funds, they would be hard pressed to find agents or distributors who would be willing to sell them these investment products.”

Earlier in November last year, a report published by Celent shows that IFAs share in mutual fund assets declined from 33% in FY 2008-09 to 24% in FY 2012-13.