SEBI’s

transaction charge (TC) of Rs. 100 – Rs. 150 has not enthused many

distributors. Around

6000 distributors had opted in when the rule was introduced in 2011. However,

many of them are said to be opting out in a bid to remain competitive.

The number of ARN holders

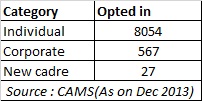

who had opted in for transaction charges has come down from 9000 to 8648 now.

“We had opted in when transaction charge was introduced. However, we had to opt out when direct plans were introduced. Clients are already seeing the return differential between regular vis-à-vis direct plans. Levying transaction charge would only add to the discomfort of clients,” said a CEO of a national distribution firm.

Most national distributors and platforms like NJ India, Fundsindia, Fundsupermart and Prudent Advisory have opted out of transaction charges.

“It is difficult to explain to clients why a transaction charge is being levied. Our sub-brokers have an option to charge advisory fee through our platform. However, since all our partners operate under our ARN it is not feasible for us to opt in,” said Chandrashekhar of FundsIndia.

Some distributors have not opted in from the very beginning when the TC was introduced by SEBI. “We never opted in because we did not want to be perceived as a company which would earn commission based on number of transactions,” said Nikhil Naik of Naik Wealth.

After the abolition of entry load, many distributors complained that collecting a separate cheque from clients was not practical. However, the transaction charge, which has an in-built mechanism for deduction too has not found favour among advisors and investors.

“I don’t feel the need to opt in for TC. These days many AMCs are offering attractive commissions. Clients are not comfortable if we levy Rs. 100 transaction charge. Not many advisors in and around Chennai have opted in,” said Alagappan Thenappan, a Chennai based IFA.

A major inconvenience with TC is that distributors don’t have the flexibility to change status on a client level. If distributors opt in, the TC will be deducted from the subscription amount from all clients. Thus, distributors can’t charge one client and not charge another client.

Earlier, distributors only had the option to opt in or opt out on all categories of products which was creating problems. Subsequently, in September 2012, distributors were allowed to opt in or opt out based on the scheme categories. Distributors can choose to levy TC from 11 scheme categories. (Liquid, gilt, debt, IDFs, ELSS, other equity schemes, balanced schemes, Gold ETFs, Other ETFs, fund of funds investing overseas and fund of funds – domestic.)

Distributors who wish to change their status on transaction charges can do so from March 1 till March 25.

Distributors have to submit an option letter to CAMS unit of AMFI.

Distributors are required to inform all their clients about transaction charges. Transaction charge is not paid if schemes are sold through the stock exchange route. AMFI has warned distributors against splitting investments in order earn more transaction charges.

Distributors can levy a transaction charge of Rs 150 for getting a new investor and Rs 100 from existing investors if they mobilize Rs 10,000 or above. The transaction charge is deducted from the subscription amount and paid to distributors.

The option exercised for a particular category of scheme is applicable across all fund houses. AMFI shares the status of distributors regarding TC with all fund houses.