Listen to this article

Of the total SIP AUM of Rs 8.70 lakh crore as on September 2023, 26% or Rs 2.28 lakh crore has stayed invested for more than five years. The next highest proportion is seen in the case of SIPs that are less than a year old i.e. 22% or Rs 1.94 lakh crore of AUM shows a longevity of less than a year.

Commenting on this figure, Bengaluru MFD Srikanth Matrubai of SriKavi Wealth said, “Post-covid, there was a rush of investors keen to invest in direct equities. However, after the rise in markets in March 2020, when the market fell, investors experienced volatility closely. Thus, they abstained from direct equity and shifted to mutual funds recently. Since such SIPs were recently opened, they have been active for less than a year.”

Adding to this, Chennai MFD Chokkalingam Palaniappan of Prakala Wealth said, “These also include do it yourself (DIY) and impulsive investors who typically make hasty decisions without consulting a professional. As much as they are quick to invest, they are also quick to exit as soon as they sense their decision was not in the best of their interest.”

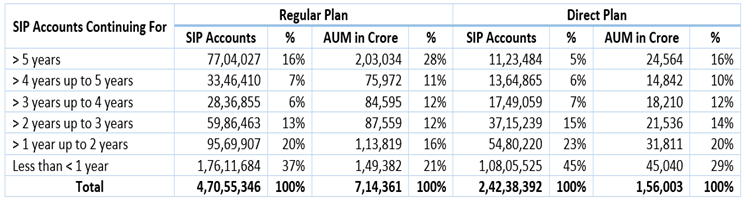

Regular Vs Direct

Of the total SIP AUM of Rs 8.70 lakh crore, regular plans or distributors contribute 82% or Rs 7.14 lakh crore and direct plans contribute the remaining 18% or Rs 1.56 lakh crore.

Notably, over 28% of the SIP AUM in regular plans has been active for more than 5 years as against 16% in direct plans.

Srikanth said, “These five years will also become ten years as investors have been with their distributor for long and have seen the power of compounding.”

“Usually, there is sustainability in the case of SIPs brought through distributors who nudge investors to stay invested till they achieve their financial aspirations”, added Chokkalingam.

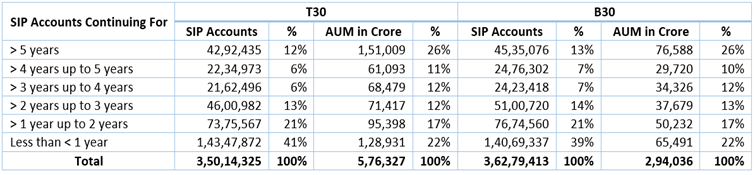

T30 Vs B30

T30 cities have Rs 5.76 lakh crore or 66% of total SIP AUM and B30 cities have the remaining Rs 2.94 lakh crore or 34%.

The longevity trend in both these geographies is similar to that of the overall industry trends i.e. 26% stayed invested for more than 5 years and 22% remained invested for less than a year.