What is your medium-term outlook on equity markets? What are the key triggers and risks for the markets from here on?

Growth-inflation dynamics are supportive of equities. Growth focused fiscal policy, improving real income levels and broadening growth momentum is likely to support corporate profitability. Going forward while all eyes are on the general elections, all the three elements of the capex cycle (housing, corporate capex & govt capex) are now firing and hence the potential global slowdown should have limited impact on India. A combination of a strong pent-up demand for housing, above average affordability and 12-year low unsold inventory should drive a multi-year virtuous housing cycle. Ditto for corporate capex with all time low debt to equity ratio for Indian corporate along with a decade high capacity utilisation level and well capitalised banking system should drive corporate capex. Govt. capex could slowdown but private capex pick-up should more than offset.

The key macroeconomic triggers crucial for equity investments in 2024 are as follows:

- Indian g-sec inclusion in JP Morgan's index: This move could enhance the attractiveness of flow for India from global investors.

- US Fed's approach to rate hikes: The US Federal Reserve's decision to hold back on rate hikes indicates a cautious approach to monetary policy which could be a positive for Indian markets.

- Robust consumption fuelled by credit growth: The combination of robust consumption and credit growth suggests a positive outlook for economic activity in India.

- Buoyant auto sales: The expectation of buoyant auto sales points to sustained demand in the automotive sector.

- Pickup in private capex: The anticipated pickup in private capital expenditure (capex) will signify growing confidence among businesses.

- Policy repo rate expectation: The projection that the policy repo rate is expected to end 2024 in the range of 5.75% to 6.0% indicates a potential path for monetary policy.

Key risks to the above-mentioned triggers would be:

- Hard landing of the US economy

- Unfavourable monsoon season which still has higher impact on the agricultural output

- Geopolitical tension - escalation of Israel war and involvement of the Middle East remains a threat which if materialized could threaten the global trade

- High global inflation leading to a chain reaction of lower demand-higher cost of production prospective losses & unemployment

- Commodity prices hardening due to Chinese growth come back could be a possibility

Many distributors have been facing difficulty in deploying fresh lumpsum money. They are not comfortable with the valuations across market capitalization. What’s your view on this?

We expect the volatility to continue over the next few months as the market-outlook is likely to remain challenging. Valuations remain marginally above long-term averages. On the back of lower commodity prices especially crude oil and with operating leverage, earnings would rise for corporates and rupee denominated trade could lead to a strong performance by the Indian economy in CY24.

Investors wanting to invest in lumpsum may invest in balanced advantage fund, value fund, tax saver funds & flexi cap funds. Investment in equity funds, particularly mid and small cap categories, should be done systematically over the next three to four months in the form of daily / weekly STPs or SIPs. While the current rally shows little signs of slowing down, retail investors must continue investing in well-managed funds via SIPs.

Flexicap funds are similar to multicap funds and ELSS. What additional benefits can investors get by investing in flexicap funds that are not possible with multicap and ELSS?

Flexi cap funds are free to invest in any market cap because they have no mandate. Multi cap funds, on the other hand, are required to have a minimum 25% allocation of their portfolio in large-cap, mid-cap, and small-cap companies.

As fund manager can raise the fund’s allocation to small and midcaps in a flexi cap fund when the market is witnessing a bull run and reverse the ratio in favour of large caps when the market turns volatile. This freedom to reverse the allocation is an add on benefit in a flexi cap fund as compared to multi cap funds as multi cap funds are restricted to have a mandate of 50% in mid and small cap companies.

While there are numerous tax savings investment options available in the market, most of them offer returns that are in line with traditional investments. Beyond tax-saving benefits, ELSS may provide better return generation potential due to the compulsory three-year lock-in as compared to other categories though unlike flexi cap funds, they come with a 3-year lock in and do not provide an opportunity to exit before the lock-in period ends.

ITI Flexi Cap Fund is the new entrant in the flexicap space. The fund has a track record of 10 months and it has performed well so far. What strategies have you deployed to generate alpha over the 3- and 5-year period?

The fund has managed to outperform its benchmark even in its short existence of less than a year.

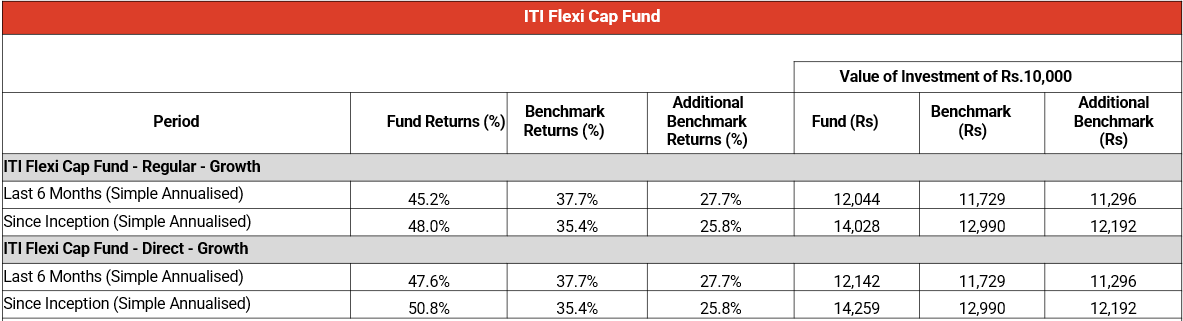

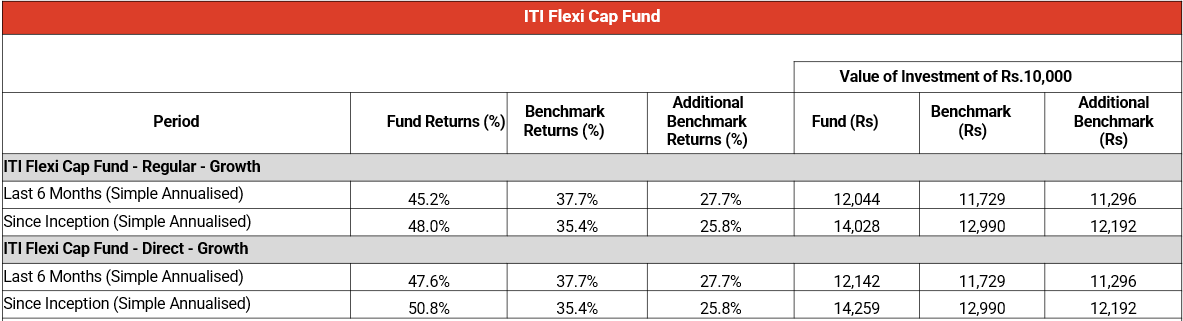

ITI Flexi Cap Fund – Category Flexi Cap Fund Performance as on 31st Dec 2023

Past performance may or may not be sustained in future and is not a guarantee of any future returns, and should not be used as a basis of comparison with other investments. Different Plans i.e. Regular Plan and Direct Plan under the scheme have different expense structure. Benchmark: Nifty 500 TRI # Additional Benchmark: Nifty 50 TRI. Mr. Dhimant Shah & Mr. Rohan Korde both are managing the scheme since 17th February 2023 .Inception Date : 17th February 2023.Simple annualized returns have been provided as per the extant guidelines since the scheme has completed 6 months but not 1 year. Face Value per unit: Rs. 10. For performance of other schemes managed by the Fund Managers, refer attached link. https://itiamc.com/admin/pdf/30012024/ITI_Flexi_Cap_Fund_Top3Bottom3.xlsx

ITI Flexi Cap -Reg -Growth NAV as on 31st Dec ‘2023 : Rs 14.14

ITI Flexi Cap -Dir-Growth NAV as on 31st Dec’2023 : Rs 14.38

The performance is clearly a result of our stock picking

We follow a 3-way investment approach to construct a portfolio from a 3-5-year perspective

Stock selection approach: bottom up approach based on:

- The financial strength of the companies

- Reputation of the management and their track record

- Good quality companies with above average growth prospects

- Companies that are facing a stable or improved industry scenario either because of the nature of their businesses or superior strategies followed by their management;

- Valuation parameters & market liquidity of the securities.

- Companies which pursue a strategy to build strong brands for their products or services and those which are capable of building strong franchises;

Sector selection approach : Top Down Approach based on:

- Emerging themes

- Macroeconomic orientation

- Emphasis on valuation to assess risk-reward & provide reasonable margin of safety

- Holistic approach to valuations

- Expected tailwinds

Market cap selection: Tactical bets across market cap

- Relative valuation among large, mid & small cap

- Economic indicator evaluation

- Liquidity scenario

- Global & domestic interest rate outlook

Note: Portfolio will be managed as per Investment objective, investment strategy & asset allocation in the Scheme Information Document (SID) and is subject to the changes within provisions of SID of the Scheme.

Unlike other flexicap funds, which have large cap bias, ITI Flexi Cap Fund has close to 50% exposure to mid and small cap companies. What’s the reason for this?

With macro situation being very dynamic and volatility increasing across asset classes, we continue with our strategy of running a well-diversified portfolio. We consider the risk reward to be the guardrail for deciding on bias towards any market cap. We are more focused on stock selection process within the sector rather than trying to take large overweight/underweight position among sectors. We also refrain from taking aggressive cash calls. While the focus continues to be on stock selection on a bottom-up basis , we have gradually tilted the portfolios towards large cap scrips compared to their midcap/small cap counter parts for ITI Flexi Cap Portfolio.

Mid and small cap companies form more than 50% of the current portfolio as it presents opportunity to benefit out of growth potential and 42.58%* of the large cap provides much needed stability to the portfolio. We construct the portfolio based on bottom up approach with risk reward opportunity being the guardrail and its outcome has been the portfolio that we have today.

*Data as on 31st Dec 2023

What makes ITI Flexicap Fund unique?

ITI Flexicap Fund offers following benefits to investors:

- Can leverage opportunities in sectors and stocks appearing across market spectrum

- Tactical allocation bets within market cap segments depending upon market scenarios

- Flexibility to align with market risk-reward perceptions

- Robust Investment controls and risk framework in place

It is ideal for:

- New investors looking for exposure across market caps with one fund

- Suitable option for long term wealth creation for investors as the fund can adapt to different market cycles

- Investors looking for diversification & reducing risks pertaining to single market cap

- Investors looking to build a core equity portfolio