Morgan Stanley has provided an exit option to investors from May 22, 2014 till June 20, 2014.

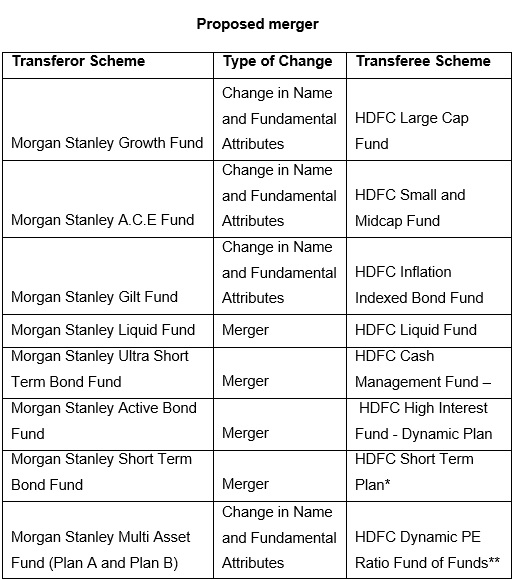

HDFC Mutual Fund is set to merge eight schemes of Morgan Stanley Mutual Fund post acquisition of the latter’s schemes. Morgan Stanley has provided an exit option to its investor from May 22 till June 20 without charging any exit load. The merger is likely to happen in June end.

Financial advisors said that the merger bodes well for investors and they are recommending their clients to stay invested in Morgan Stanley schemes. “HDFC has a good track record and they can manage the schemes of Morgan Stanley well. We have advised our clients to stay invested. HDFC has managed the schemes of Zurich well,” said Rajesh Hattangady of THiiNK.

Nikhil Kothari of Etica Wealth Management said “Investors have to see if the transferee scheme’s objective is similar with their existing scheme. For instance, HDFC Inflation Indexed Bond Fund is different from Morgan Stanley Gilt Fund. Similarly, A.C.E Fund is not similar to HDFC Small & Mid Cap Fund. Though HDFC is a good AMC, investors have to see if their risk appetite matches with that of the new scheme. If not, they can move out and invest in schemes having similar objectives within HDFC or with any other fund house. Debt fund investors of Morgan Stanley can remain invested.”

Investors in the schemes of Morgan Stanley have to bear capital gain tax after the merger since merger amounts to redemption. While no long term capital gains tax has to be borne by investors if they have completed one year in equity scheme, debt fund investors have to bear capital gains tax of 10% without indexation and 20% with indexation.

Morgan Stanley Multi Asset Fund (Plan A and Plan B), Plan A will be renamed as HDFC Dynamic PE Ratio Fund of Funds and Plan B will be merged into it.

To avoid duplication of schemes, HDFC will also merge its HDFC Focused Large-Cap Fund into HDFC Equity Fund on June 20, 2014. Launched in 2006, HDFC Focused Large Cap Fund manages Rs. 406 crore. There will be no changes in the fundamental attributes of HDFC Equity Fund.

HDFC Short Term Plan which will accommodate investors of Morgan Stanley Short Term Bond Fund will undergo change in its fundamental attribute.

As on April 2014, HDFC AMC managed Rs. 1.24 lakh crore while Morgan Stanley had assets under management of Rs. 2,572 crore as on March 2014.