FMPs with tenure less than 36 months, redeemed after April 1, 2014, will no longer be eligible for indexation benefits, or lower long-term capital gains tax.

How does the budget impact the investors in debt mutual funds?

There are three things proposed in the budget that are negative for investors in debt funds.

a. Investors have to hold a debt fund for 36 months, to get any benefit of long-term capital gain (LTCG). Currently this number is 12 months. (Effective date 1 April 2014)

b. The choice of paying taxes at 10% without indexation on LTCG is no longer available. LTCG from non-equity oriented funds would be taxed at 20% tax after indexation. (Effective date 1 April 2014)

c. Dividends distributed by mutual funds are subject to dividend distribution tax (DDT). This will now be paid on the gross basis and not on net amount of dividend paid. (Effective date 1 Oct 2014)

How are FMPs likely to be impacted?

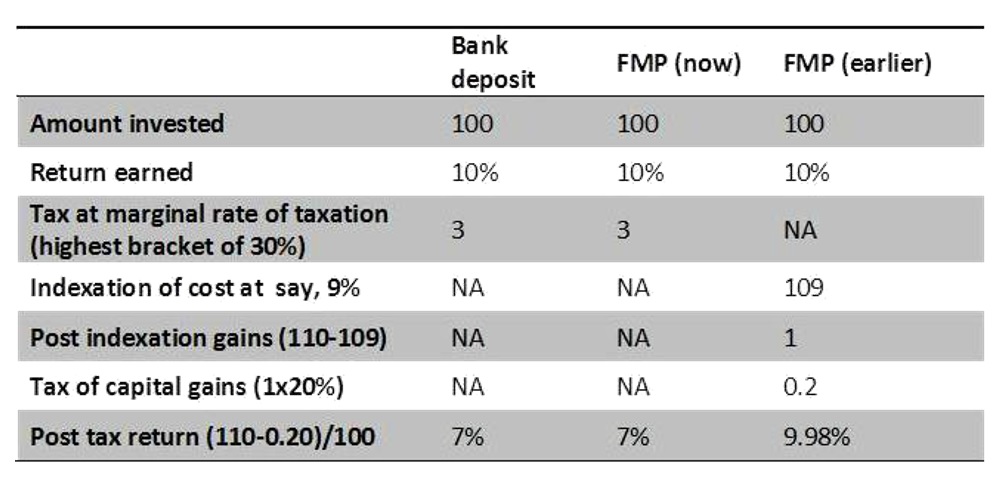

FMPs with tenure less than 36 months, redeemed after April 1, 2014, will no longer be eligible for indexation benefits, or lower long-term capital gains tax. The redemption proceeds will be subject at tax at the marginal rate of tax of the investor (nil, 10%, 20% or 30% as the case may be, plus surcharge and cess).

What will happen to the return on existing FMPs that mature after 1st April 2014, but do not have a tenure of 36 months?

The effective post tax return to such investors will be lower. The FMP will be as good or bad as a bank deposit.

An investor who bought this FMP in March 2014, hoping to get 9.98% return, will now earn 7% post tax.

How do FMPs and debt funds compare with bank deposits now?

For tenures less than 36 months, FMPs, debt funds and bank deposits are not different in terms of tax benefit. They may differ in terms of return. A debt fund may earn capital gains, but may be subject to expenses and loads. A bank deposit will only earn interest income, and may be subject to TDS.

For tenures longer than 36 months debt funds and FMPs may look better than bank deposits of the same tenure, because they will be able to offer indexed capital gains, which bank deposits do not offer.

Should one redeem the debt funds and FMPs?

Any gains from redemption before 36 months of holding will be subject to STCG tax. Since FMPs are closed end funds, a mid-course change in tax aspect makes it tough for investors to act. FMPs are listed and can be sold only on stock exchanges. The price an investor may get will depend on liquidity in the markets, and if everyone tries to sell, the price is likely to fall further.

In the case of a debt fund that is open-ended, investors holding for a period of 36 months or more, are still eligible for indexation benefits. Pre-mature sale will increase the tax liability, unless the investor is an entity that is exempt from taxes.

How does a bond compare with debt funds now?

A listed bond including a zero coupon bond, will continue to enjoy the benefit of being regarded as a long-term capital asset after a holding period of 12 months. A listed bond with a tenure over 1 year but less than 3 years, will get a better post-tax return compared to a debt fund or FMP. Longer tenure bonds (36 months or more) are no different from debt funds in terms of tax benefits.

Will the new rules apply only for debt funds and FMPs bought after the effective date of 1 April 2014?

The new rules change the taxability of capital gains that accrue after the effective date of 1 April 2014. Capital gains accrue on sale, not purchase. Therefore any debt fund or FMP, bought after 1 April 2011 and sold before the expiry of 36 months from the purchase date, will be subject to STCG tax under the new regime.

Will the STCG apply only for FMPs and debt funds that are redeemed within 36 months?

The new STCG rules will apply for redemption, switch, systematic transfer, or systematic withdrawal from any non-equity fund before completing 36 months of holding period. Since all funds that invest less than 65% money in equities are treated as non-equity funds for taxation, the change will also impact gold funds, international funds, fund of funds, and other non-equity oriented funds such as MIPs.

Will a dividend option work to the advantage of investors in non-equity funds?

There might be a slight advantage in opting for dividend option for a less than three years holding period, if the investor falls in the 30% bracket. This is because dividend is subject to dividend distribution tax (DDT) at 25% for individual investors. For investors whose tax rate is lower than 25%, growth option is better than dividend option, since their STCG will be taxed at their marginal rates of taxation. The rate of DDT is flat 25% and hurts investors with tax rate lower than 25%. Investors in bank deposits only have to pay TDS (10%). They may also be able to claim some refunds.

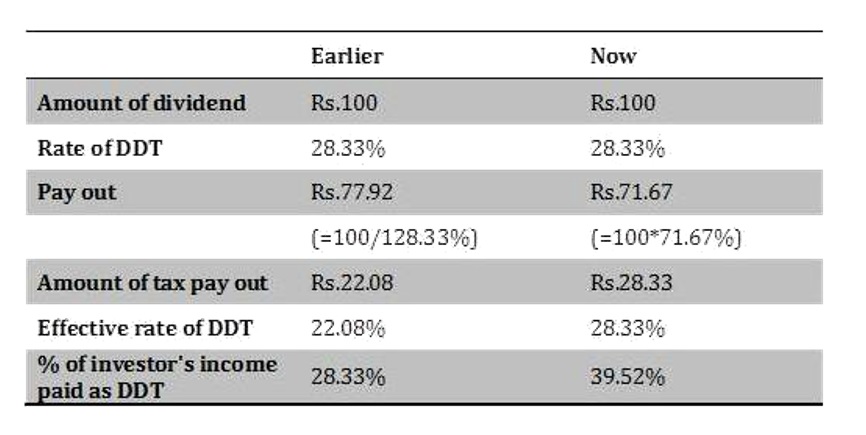

What is the effective rate of DDT now applicable on mutual funds?

Investors using the dividend

option, enjoyed a lower effective DDT. There was an arbitrage opportunity

there. DDT was applied on net dividend paid out, at 28.33% effective (25%

DDT+cess+surcharge). This rate will now apply on gross basis. See computation

below:

The above calculation takes into account 10% surcharge and 3% education cess.

Notice that DDT is now payable on the gross amount of Rs.100 and not on the actual amount paid out as dividend. In other words, almost 39% of the investor’s income would be go to the government as tax, instead of 28% earlier. This will be applicable w.e.f. from October 1, 2014.

Note: The above discussion is based on the proposals introduced in the Finance Bill, 2014 and can have amendments before it becomes an Act.

This article was first published on Centre for Investment Education & Learning blog and is reproduced here with their permission