DSP BlackRock Micro Cap Fund is one of the best performing micro-cap funds on our platform this year. Since the ascent of a reformist government at the centre in May 2014, some of our mid and small cap funds have not only delivered superlative performance but have also attracted investor’s attention. The said fund was a part of our recommended funds list for the first time in June 2010. However, as the fund had become open-ended only in June 2010, we felt that the analysis on the same was skewed. Hence, the fund did not find a place in our recommended funds list in 2011. The fund has been an open-ended fund for more than 4.5 years now and the results of our model indicate that this is one of the best performing mid and small cap fund we have on our platform today. Vinit Sambre has been at the helm ever since the fund became open-ended in nature. Hence, the superlative performance of this fund can be considered as the track record of the fund manager as well.

Sambre follows a bottom up approach while selecting stocks in his portfolio.

We quizzed Sambre to give us more details on the strategy that he has been following in this fund, and the criteria taken under consideration when selecting companies for the portfolio. The answers have been summarized below:

- Companies which can be owned not only in a bull market but even in a bear market.

- Concentrated Portfolio of 45 stocks with the top 10 stocks garnering 40%-45% of the corpus depending on conviction.

- Sound Businesses with strong fundamentals irrespective of market cycles.

- Quality of management in terms of their capability and credibility.

- Past 5 to 10 year performance of the companies across different market cycles.

- Ratios like Cash Generation, ROC, Incremental Capital Allocation

- Companies with stable businesses which have consistently delivered across economic cycles will have a higher allocation in the portfolio.

- Calculated risk will be taken in the form of allocating a small part of the corpus to turnaround companies which are run by good management but impacted by a bad cycle.

Portfolio

This is a fund which sticks to its mandate of being true to its label. Sambre defined micro-cap stocks as those belonging to companies which are beyond the top 300 by market capitalization.

As per the mandate, 65% of the portfolio should be invested in micro-cap stocks. On the other hand, 30% of the concentration will be in mid & small cap stocks, while cash allocation will be to the tune of 3% to 4%.The large cap allocation is kept at nil so that it does not change the nature of the fund. According to Sambre, the 35% allocation into mid & small cap stocks and cash acts as a buffer to meet any urgent liquidity requirements.

An interesting observation that can be made here is that during April 2012 to April 2014, the funds average allocation into micro caps was 73%. Since April 2014, we have seen the allocation into this category being reduced to 44.77% in March 2015 vis-a-vis 75.9% in April 2014.

We had mentioned in the earlier part of the note that the fund manager believes in having a concentrated portfolio consisting of 45 stocks. However, since April 2014 until March 2015, the number of stocks have increased from 44 to 60.

“Last year, we faced strong inflows into the fund. In fact, we had to take measures to limit the pace of further inflows from October 2014. We were finding it difficult to deploy such inflows into micro caps in a short time period as it led to higher impact cost. Hence, as the corpus moved up from Rs.404 crore in April 2014 to Rs.1922 crore in April 2015, we had to increase the number of stocks in the portfolio. Currently we are in the process of consolidation and are looking to work with around 50 to 55 stocks,” said Vinit Sambre, Fund Manager, DSP BlackRock Mutual Fund.

As on March 2015, the fund held 60 stocks out of which 9 of them have been a part of the portfolio during the entire 36 months of analysis. This in short means that the portfolio is actively managed and as Sambre has got his bets right, the overall performance of the fund has also improved drastically over a period of time.

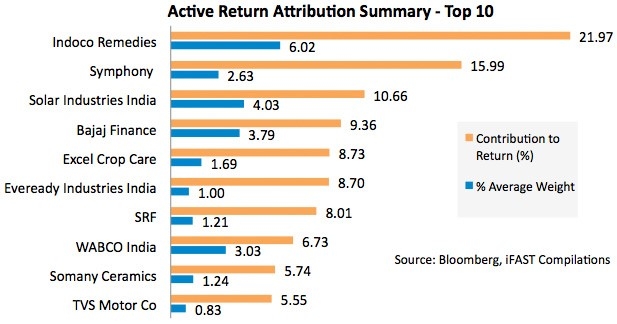

We had also done an attribution analysis to understand the stocks which have contributed to the returns over a period of 3 years (April 2012-March 2015).The result are given below.

Performance

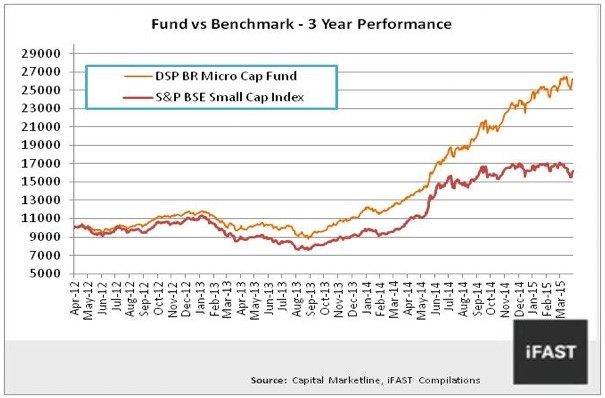

If on April 2, 2012, an investor had parked a surplus of Rs. 10,000 in DSP BlackRock Micro Cap Fund and the benchmark that is S&P BSE Small Cap Index, then the corpus would have been Rs. 26,292.61 and Rs. 16,155.47 by March 31, 2015.

DSP BlackRock Micro Cap Fund, an aggressive bet in the micro-cap space is purely run on the conviction of the fund management team. The consistent performance delivered by this fund across the different time periods is a clear indication that Sambre’s conviction, along with the strategy followed by him since he took over the fund is working in the fund’s favor. Aggressive investors who want to create the extra alpha in their portfolio can consider this fund which is true to its label of being a micro-cap fund across different market cycles. Investors taking an exposure into this fund after reading this note should be willing to bear with the volatility associated with such a fund and the time horizon needs to be in the range of 3 years to 5 years.

Our Take:

DSP BlackRock Micro Cap Fund, an aggressive bet in the micro-cap space is purely run on the conviction of the fund management team. The consistent performance delivered by this fund across the different time periods is a clear indication that Sambre’s conviction, along with the strategy followed by him since he took over the fund is working in the fund’s favor. Aggressive investors who want to create the extra alpha in their portfolio can consider this fund which is true to its label of being a micro-cap fund across different market cycles. Investors taking an exposure into this fund after reading this note should be willing to bear with the volatility associated with such a fund and the time horizon needs to be in the range of 3 years to 5 years.

The views expressed in this article are solely of the author and do not necessarily reflect the views of Cafemutual.