Fund houses are pushing gold fund-of-funds to attract retail investors because of the constraints in investing in gold ETFs via demat accounts.

AMCs have taken the fund-of-funds route for making gold ETFs popular among retail investors, especially those who do not have a demat account. Most fund houses which run gold ETFs have launched gold fund-of-funds. The latest to join the bandwagon is Goldman Sachs Mutual Fund. It filed an offer document with SEBI recently to launch a gold fund-of-funds. This fund will predominantly invest in its Gold BeES.

Though IFAs have not been very active in recommending ETFs, gold funds are more popular among distributors for a number of reasons. Investors do not have to bear any annual maintenance charges or pay brokerage for buying gold funds. AMCs which have launched gold fund-of-funds have also promoted the advantages of investing through the physical route rather than ETFs.

“Gold funds can attract a large number of investors. These funds allow investors to invest in gold ETFs without a demat account. A gold fund-of-funds cannot buy gold directly, so the corpus is invested in gold ETFs,” says Debashish Mallick, MD & CEO, IDBI Mutual Fund.

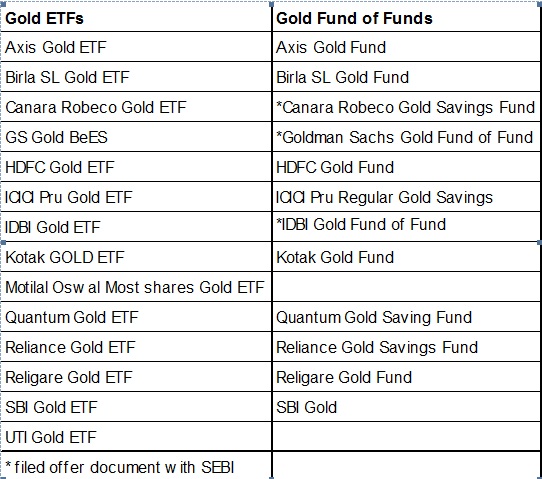

The trend caught on after Reliance launched its Reliance Gold Savings Fund last year. IDBI Mutual Fund which launched its gold ETF in November 2011 has also filed an offer document with SEBI for its IDBI Gold Fund of Fund. Similarly, Canara Robeco has filed for its Canara Robeco Gold Savings Fund.

Recently Union KBC has filed an offer document with SEBI for its Union KBC Gold Fund. Principal and IIFL have also sought SEBI approval for launching gold ETFs.

Only two AMCs—UTI and Motilal Oswal—who have gold ETFs have not launched their own gold fund-of-funds yet. Nitin Rakesh, MD & CEO of Motilal Oswal AMC, had told Cafemutual earlier that the fund house is looking at a gold fund-of-fund launch.

Another reason for the sustained interest in gold funds is the fact that the category continues to be favoured by investors. Lakshmi Iyer, Sr. VP and Head – Fixed Income & Products, Kotak MF, believes that gold could continue to attract investors’ attention in the year ahead. “The possibility of stagflation in the economy may give rise to uncertainty in the equities and debt market. On account of that gold may continue to remain one of the key investible assets in the year ahead.”

The assets managed by gold ETFs have gone up to Rs

10,218 crore in April 2012 from Rs 4,400 crore as on March 2011.